Special Situations Team

Overview

BCLP’s multidisciplinary Special Situations team is comprised of seasoned transactional lawyers and litigators who routinely advise clients on matters that require unique strategies and out-of-the-box solutions. Our integrated approach allows us to leverage situations that require more than a conventional M&A or litigation team to preserve and unlock value in multi- dimensional circumstances.

We are typically called in by executive management, boards of directors, PE sponsors, lenders, and distressed investors where the source of value dilution is driven by a confluence of:

- Operational challenges or crises

- Breakdowns in key supplier or vendor relationships

- Hostile shareholders or lenders

- Liquidity constraints

- Insider misconduct or fraud

- Nonperforming business unit or division

- Compliance violations that have freezing impact on business

Our Approach

At BCLP, we pride ourselves on our investments to build long-term relationships with our clients by understanding their businesses, their industry, and their people and being part of their team. We have a strategic approach to special situations where we fully invest our resources to understand the matter at hand, deploy the best firm resources we have unique to your condition, and create the most innovative strategy to achieve your long-term goals.

Why BCLP?

We’re fixers. Our methods of assistance to our clients can take many forms and involve a broad spectrum of disciplines within the firm. Rely on our team of experienced lawyers to navigate the complexities of unique business and legal circumstances that require:

- Surgically divesting performing / non-performing assets;

- Extricating the business from crisis and litigious situation without disrupting commercial continuity;

- Identifying alternative structures for injecting emergency bridge capital on a mezzanine or junior basis through unconventional structures;

- Resolving disputes without protracted litigation;

- Identifying insider or compliance violations and remediating in a targeted manner.

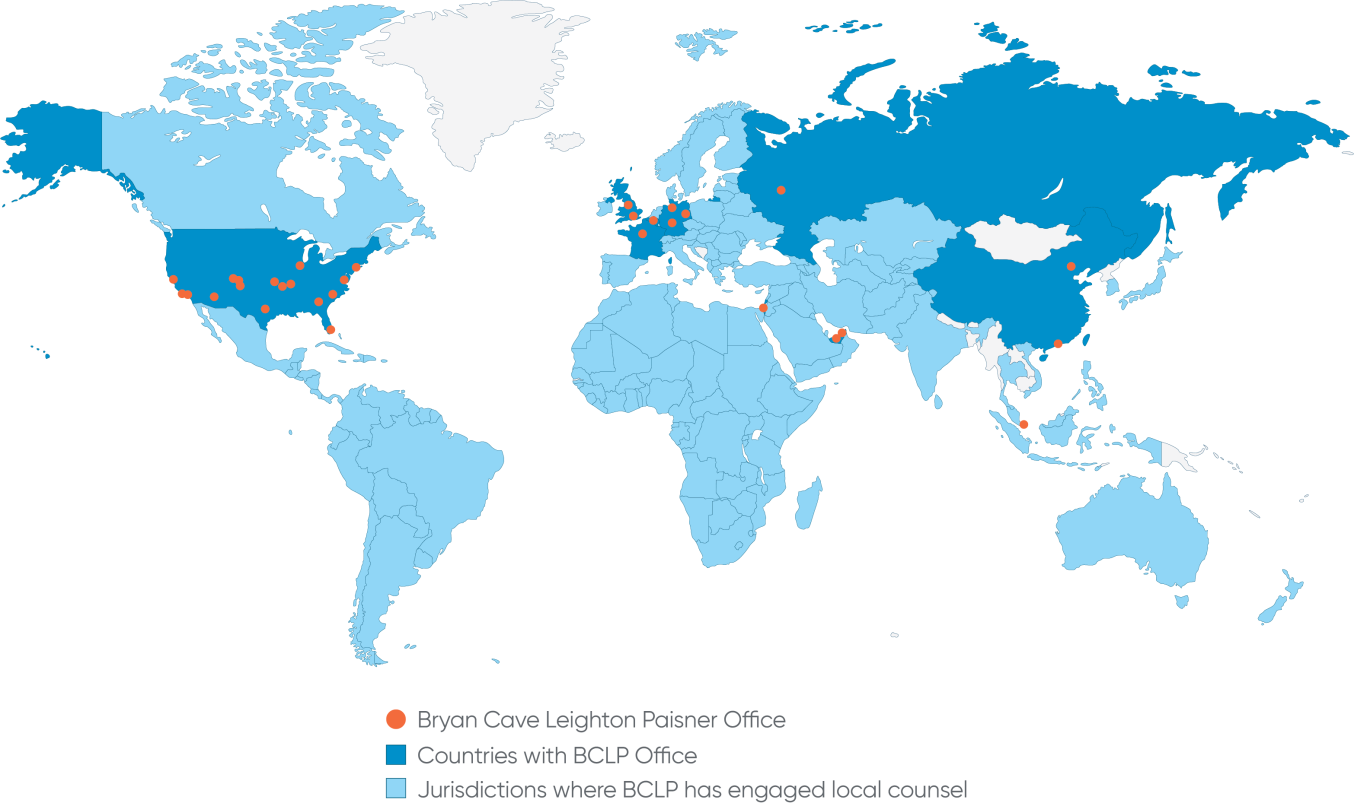

We’re uniquely positioned. Our industry focused team and global footprint allows us to be fully engaged with you every step of the way so that we identify the best solution and achieve your goals. We know the legal issues and regulations businesses must navigate to succeed in both day-to-day operations and large, strategic initiatives. Our investment in understanding key market forces enables us to provide comprehensive advice that accounts for critical industry trends. Our knowledge is derived from working on a day-to-day basis with in-house counsel and upper management to understand the source of distress from those with the closest perspective.

We’re where you need us to be. We have extensive international experience within our teams and can offer tailored services with uniquely qualified personnel to work on special situations matters across the globe, including the U.S., Europe, Asia, Africa, and the Middle East. Where and when necessary in certain jurisdictions, we will work closely alongside uniquely qualified advisors to provide our clients with an appropriate and desired legal work product to effectively resolve whatever special situation they need to address.

Experience

US

- Rescued Loot Crate, a subscription- based tech and popular culture goods supplier, from brink of meltdown through an expedited 40-day section 363 sale process in its chapter 11 cases. Our representation required 72-hour negotiation of debtor in possession financing and creation of solutions to address first in time issues arising from credit card processors seeking to exercise remedies, Wayfair sales tax issues, and challenge of merchant cash advances.

- Acted as workout, corporate, and bankruptcy counsel for a privately- owned, distributor of shooting sports products, including firearms, ammunition and accessories, to approximately 3,000 independent retail, completed Bankruptcy Code section 363 sale transaction by which client/debtor was sold to industry competitor.

- Represented a mid-market retailer in developing a structure that obviated the need to obtain preferred shareholder consents allowing for the raise of approximately $5 million of emergency bridge notes, $20 million of senior refinancing, and issuance of warrants.

- Represented an ad hoc noteholder group in successfully forcing Energy XXI, in its chapter 11 cases, to deviate from its initial chapter 11 plan by seeking to effect a spin-off acquisition of subsidiary EPL Oil & Gas at materially higher valuations. This ultimately resulted in a compromise that generated a return 5-7 times greater than the original proposal.

- Represented a multi-national company, with in excess of $3 billion of revenue, preparing to commence a sale process in developing and successfully executing on first-in-time strategy to resolve a protracted dispute with EU works councils and unions in order to effect a time sensitive closure of its maintenance and repair facility.

- Acted as corporate, litigation, and workout counsel for privately- owned, independent price comparison service website for products, travel, and education, executed on sales transactions in multiple foreign jurisdictions and negotiated discounted payoffs to several creditors in the technology industry.

- Represented a multi-national publicly traded company in restructuring global operations in over twelve countries to bring business units into compliance with foreign labor, tax, corporate, and immigration laws, as well as remediate US compliance concerns.

UK

- Advised the London Legacy Development Corporation (and Greater London Authority) on its investment in and the restructuring of the E20 Stadium LLP (the vehicle which owns the London Stadium) in connection with and following Newham Council’s negotiated exit from the investment.

- Advised German-headquartered Meyer Quick Service Logistics GmbH & Co KG and its UK subsidiary Quick Service Logistics UK LP opposite KFC & Taco Bell and DHL Supply Chain Ltd following the service failures, which led to over 700 KFC outlets in the United Kingdom closing due to incomplete food deliveries.

- Advising The Unite Group plc; LSAV (Aston Student Village) LP on the acquisition of student homes, using a discrete insolvency process.

- Advising Carval Investors on the acquisition of NPL secured against 350 Boots stores and restructuring the loan.

- Advised SDX Energy Inc. on the acquisition of a portfolio of oil and gas production and exploration assets in Egypt and Morocco, which were held by Circle Oil plc, from the administrators of one of Circle’s subsidiaries for $30 million.

- Acted as corporate and workout counsel for privately-owned provider of hotel booking technology and full-service digital marketing and distribution solutions/CRS company, including as legal counsel on cross-border transaction resulting in merger of company with well-known e-commerce platform.

- Advising Macquarie as owner on debt restructuring and eventual sale of investment to Ericsson (media).

- Advised Long Harbour Residential Freehold Limited (and their ultimate funder, M&G) on the restructuring and acquisition of a £400 million ground rent portfolio from the Consensus Group.

- Advised a US private equity fund on the enforcement of its security over and the subsequent disposal to a UK clearing bank by way of receivership of a series of securitized notes linked to the reversionary leasehold interests in two high profile City of London office blocks.

- Advising Halite on UK infrastructure deal with significant liquidity issues.

- Advised Amber Infrastructure as the lender on a UK infrastructure project in distress due to liquidity stretch following the collapse of Carillion.

- Advised real estate private equity fund on its ‘credit bid’ acquisition of mixed use 190,000 square foot development site located in Central London – including a unique blessing application in Jersey to approve the transaction.

Germany

- Advised various issuers of German law governed SME/corporate bonds on various out-of-court restructurings (based on German Bond Act; collective action clauses), including debt-to-debt, debt-to- equity, amend to extend, cash to PIK-interest etc.

- Advised Robus Capital and Coltrane Master Fund as anchor investors in 3W Power / AEG Power Solution restructuring (loan-to-own: from investment throughout various debt instruments to 85% joint shareholding in group).

- Advised Cerberus on various asset backed loan portfolio acquisitions, including in particular advice on loan-to-own strategies.

- Advised Anchorage in connection with acquisitions of single distressed debt pieces.

France

- Advising a French company in a corporate restructuring deal using a pre-bankruptcy procedure to move a loss-making subsidiary outside the consolidated group and avoid liabilities in case of future failure of this company.

- Advising a foreign turnaround investment fund in the context of several acquisitions and sales of distressed assets in France, and complex carve-out transactions, including in the framework of pre-insolvency and insolvency proceedings and implying negotiations with public creditors and authorities as well as debt rescheduling discussions.

- Advised a UK packaging group of companies on debt recovery matters in the context of pre-insolvency and insolvency proceedings of French debtor companies.

- Advised a PRC shareholder in replacing the team managing their French operations in the context of an important restructuring matter and the confidential process of preparing the closure of a factory. The engagement involved discussions with the French government.

- Advising the largest European car dealership group on the acquisition of one of its direct competitors, in the context of a pre-insolvency proceeding homologated by the commercial court.

Asia

- Advising a Japanese integrated trading and investment conglomerate on the enforcement of its creditor rights and the subsequent sale of its various nonperforming loans in Asia including but not limited in Indonesia, Bangladesh, Mongolia, Thailand and the Philippines.

- Advised an Asian investment fund as lender on a US$425 million secured and syndicated facility agreement entered into with a corporate in Africa in relation to oil and gas assets in Iraq and Sub Saharan Africa.

- Advised senior lenders in relation to refinancing and restructuring of the senior debt and high yield obligations of a leading cable and data center company, including financing its data centers in Hong Kong SAR and in Singapore.

- Advising a sponsor in relation to the restructuring of its debt and equity investment in a security business in the Middle East including the spinning off and debt forgiveness in multiple jurisdictions where various operating entities were established.

Related Insights

12 November 2020

24 June 2020