Insights

UK National Security & Investment Bill – the Potential Ramifications for Real Estate Transactions

Dec 11, 2020Summary

The new National Security and Investment Bill, which aims to provide the Government with the necessary powers to scrutinise and intervene in business transactions to protect national security, will introduce a mandatory notification regime across 17 sectors in the UK economy. A voluntary notification scheme will encourage notification from parties who consider that their transaction may raise national security concerns. The regime is likely to have ramifications for a wide range of real estate transactions, some of which may catch even a sophisticated investor unaware.

THE REGIME

The new regime, which is currently still going through the Commons but scheduled to be enacted in Spring 2021, would then take retrospective effect from 12 November 2020 and is far more wide-reaching than anticipated. The regime:

- enables the Secretary of State to issue “call in” notices to call in acquisitions of qualifying sensitive entities and assets (“trigger events”) in order to carry out a national security assessment;

- creates a mandatory notification system for proposed acquirers of qualifying sensitive entities and assets in sectors perceived to be high risk (including data infrastructure, energy and transport) to seek authorisation and to obtain approval from the Secretary of State before completing their acquisition; and

- creates a voluntary notification system for others to encourage notifications from parties who consider that their trigger event may raise national security concerns.

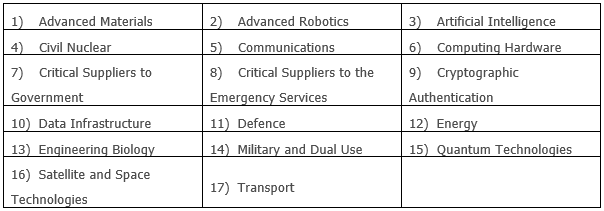

The 17 key sectors which are perceived to be high risk are set out in the table below.

The mandatory notification system is of key significance to the real estate sector. The “trigger events” which enable the Secretary of State to issue “call in” notices are:

- where the acquirer would gain control of more than 25%, 50% and 75% of votes or shares in a qualifying entity or would be able to block or pass a corporate resolution; and

- where the acquirer would gain control of more than 15% in shareholding or voting rights in a qualifying asset.

Failure to notify and obtain pre-approval for a transaction which is subject to the mandatory filing obligation will render the relevant transaction void and expose the parties to substantial fines and/or potential imprisonment. For detailed commentary on the scope of the Bill (as currently drafted) please see this blog (entitled “Highly impactful - UK National Security & Investment Bill introduces mandatory Government review of a wide range of transactions”).

THE POTENTIAL RAMIFICATIONS FOR REAL ESTATE

From a property perspective, investors need to start considering whether their current and future transactions could be called in, particularly where they sit across data infrastructure, energy and/or transport sectors.

At this stage it is unclear exactly how these sectors will be defined: the consultation to decide that is open until 6 January 2021. However, as currently drafted, whilst some appear to be self-explanatory, such as the purchase of a harbour, port, airport, gas pipelines or refineries, others are less apparent. For example, data infrastructure covers not just a person who operates data infrastructure but also a person who owns a site on which such operations take place.

Whilst coming within the ambit of the legislation will only rarely prevent a transaction proceeding in the long term, the obligation to notify and then wait 30 business days for clearance, and/or the due diligence around whether a notification should be made on a voluntary basis, will have implications for the liquidity of that asset/sector. We could see a change in investor appetite around higher risk assets and sectors.

Other seemingly innocuous transactions that could be caught include:

- group-reorganisations which involve the transfer of “high risk” assets;

- leases of / licences to sub-let assets to tenants within the “high risk” sectors; and

- telecoms wayleaves.

Similarly, as currently drafted, it is unclear whether sites in close proximity to sensitive sites could inadvertently be caught.

WILL THE ACT MAKE THE UK A LESS APPEALING PLACE TO INVEST IN REAL ESTATE?

The Bill should not be considered as an indication of a less welcoming approach to inward investment into the UK generally, since the vast majority of acquisitions will fall outside its scope. However, to put its likely reach into context, the current number of UK mergers and acquisitions which are subject to government review is c60 per annum; the number of notifications forecast to be made under the new regime is estimated to be 1000+ per annum. Investors in UK real estate need to be aware, therefore, not just where the acquisition is self-evidently sensitive or strategic, but also where it could inadvertently trigger the application of the new regime.

WHAT NEXT?

We expect the consultation to result in some material changes to the Bill. If you would like to discuss a response to the consultation or the wider invitation from the Department for Business Energy & Industrial Strategy to feedback on the potential operation and reach of the regime, please get in touch.

Related Capabilities

-

Real Estate