Insights

Federal Reserve Board Expands Scope and Eligibility of Main Street Lending Program

May 07, 2020Summary

On April 30, 2020, the Federal Reserve (the “Fed”) released additional details about the Main Street Lending Program (“MSLP”), and announced that it is expanding the scope of and eligibility for the program. Initially, the MSLP consisted of two loan facilities: (1) the Main Street New Loan Facility (“MSNLF”) and (2) the Main Street Expanded Loan Facility (“MSELF”). In response to public comment, the Fed created a third loan option, the Main Street Priority Loan Facility (“MSPLF”), and released updated term sheets (the “Term Sheets”)[1]and answers to frequently asked questions (the “FAQ”)[2].

The Main Street Lending Program is fully operational as of July 6, 2020. Some details in this post may have changed since publication. For more recent thought leadership on the program, please visit the posts published on June 2, 2020 and June 17, 2020.

The Fed intends that the MSLP will ensure credit flow to small and mid-sized businesses that were in good financial standing prior to the COVID-19 crisis, on terms and conditions to be set by the Federal Reserve Board. Funds for MSLP were appropriated pursuant to Section 4027 of Title IV of the Coronavirus Aid, Relief, and Economic Security Act (the “CARES Act”), and the program is being established under Section 13(3) of the Federal Reserve Act (12 U.S.C. § 344).

The Department of the Treasury (“Treasury”) will use funds appropriated to the Exchange Stabilization Fund under Section 4027 of the CARES Act (part of the $454 billion previously authorized under the CARES Act) to make a $75 billion equity investment in a special purpose vehicle (“SPV”). The SPV will purchase participations in loans made pursuant to the program by “Eligible Lenders” (defined below) to “Eligible Borrowers” (defined below), in an amount of up to $600 billion. The SPV and the Eligible Lender will share risk on a pari passu basis. The SPV will cease purchasing participations on September 30, 2020, unless the Fed and the Treasury extend the program, and the Federal Reserve Bank of Boston will administer and operate the SPV until its assets mature or are sold. Unlike Paycheck Protection Program (“PPP”) loans, MSLP loans are full-recourse and not forgivable.

The April 30 publications contain a few notable clarifications of and changes to the MSLP:

- Methodology to be used to calculate adjustments to an Eligible Borrower’s 2019 earnings before interest, taxes, depreciation, and amortization (“EBITDA”).

- The addition of a third category of loan facilities - MSPLF loans.

- Decreased minimum loan size for MSNLF loans, and increased minimum and maximum loan size for MSELF loans.

- Clarification that loans under each facility type may be secured or unsecured.

- Clarification regarding restrictions on paying other debt while the MSLP loan is outstanding.

- Increase in maximum size of eligible businesses (in both number of employees and annual revenues) and clarification regarding inclusion of affiliates in calculations.

- Removal of requirement that Eligible Borrowers have to self-certify as to exigent circumstances presented by COVID-19.

The addition of MSPLF allows participation in the program by companies with higher debt burdens. Lenders participating in MSPLF loans will be required to retain a higher share of risk—15% rather than the 5% required under MSNLF and MSELF. Unlike MSNLF and MSELF, MSPLF can be used to refinance existing debt.

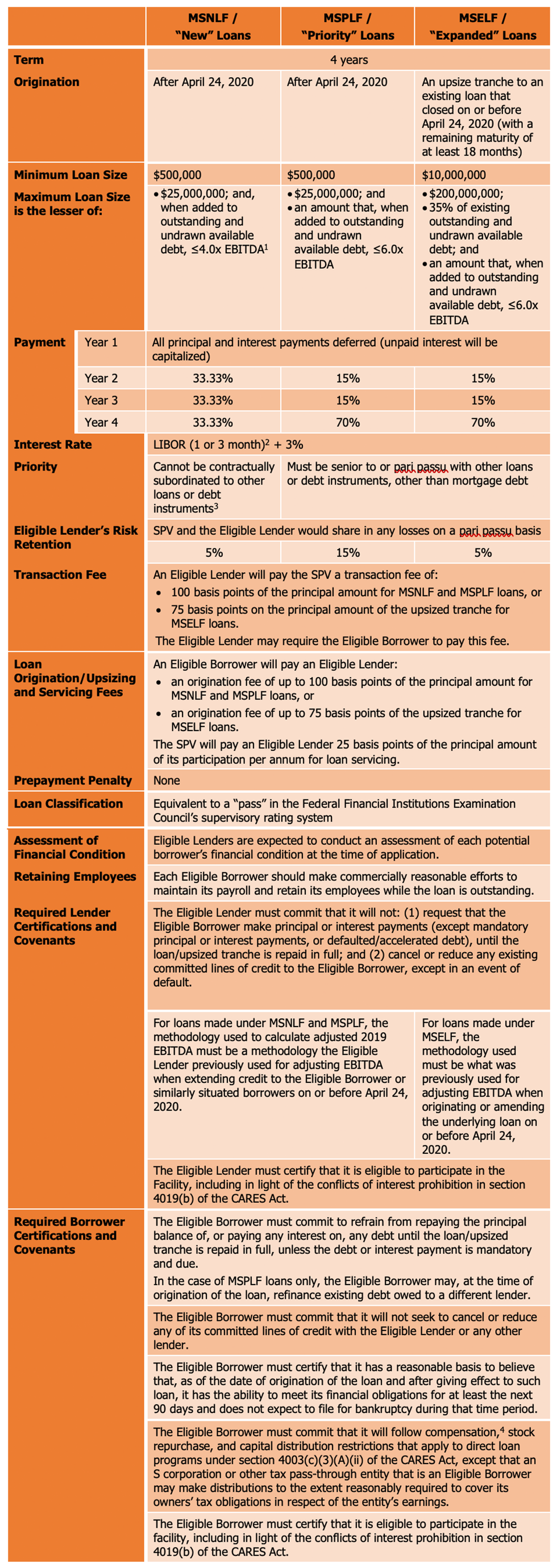

The updated Term Sheets indicate the following:

An “Eligible Lender” is a U.S. federally insured depository institution (including a bank, savings association, or credit union), a U.S. branch or agency of a foreign bank, a U.S. bank holding company, a U.S. savings and loan holding company, a U.S. intermediate holding company of a foreign banking organization, or a U.S. subsidiary of any of the foregoing.

An “Eligible Borrower” is a (for profit) Business[3]that:

- was established prior to March 13, 2020;

- is not an Ineligible Business[4];

- has 15,000 or fewer employees or had 2019 annual revenues of $5 billion or less;

- is created or organized in the U.S. or under the laws of the U.S. with significant operations in and a majority of its employees based in the U.S.;

- has not received specific support pursuant to Section 4003(b)(1)-(3) of the CARES Act[5];

- must elect among the MSNLF, MSPLF, MSELF and the Primary Market Corporate Credit Facility, and may not participate in more than one of these programs; and

- must be able to make all of the certifications and covenants required under the MSLP.

MSLP Facilities Terms and Requirements:

An “Eligible Loan” is a secured or unsecured term loan[6]made an Eligible Lender to an Eligible Borrower, as outlined in the table linked below. The table below and the Term Sheets provide the minimum requirements for MSLP loans, and Eligible Lenders are expected to apply their own underwriting standards and conduct their own assessment of each application.

Noteworthy Clarifications

Number of Employees: In determining whether a Business has 15,000 or fewer employees, the FAQ clarifies that the framework in the SBA regulation (13 CFR 121.106) is applicable. Full-time, part-time, seasonal or otherwise employed persons are included but volunteers and independent contractors are excluded. The FAQ also clarifies that employees of affiliates are included in the calculation. Affiliates are determined in accordance with the affiliation test set forth in 13 CFR 121.301(f). Businesses should use the average of the total number of persons employed by the proposed borrower and its affiliates for each pay period over the 12 months prior to the origination or upsizing of the loan under the MSLP.

How to Calculate 2019 EBITDA: For loans made under MSNLF and MSPLF, the methodology used to calculate adjusted 2019 EBITDA must be a methodology the Eligible Lender previously used for adjusting EBITDA when extending credit to the Eligible Borrower or similarly situated borrowers on or before April 24, 2020. For loans made under MSELF, the methodology used must be what was previously used for adjusting EBITDA when originating or amending the underlying loan on or before April 24, 2020.

Revenue Calculation: As with the number of employees, revenues of affiliated entities are included in determining whether a Business had 2019 annual revenues of $5 billion or less. Affiliates are determined in accordance with the affiliation test set forth in 13 CFR 121.301(f). A Business may use its and its affiliates’ annual “revenue” on its audited GAAP financial statements or it may use annual receipts as reported to the Internal Revenue Service (and, for this purpose, “receipts” has the same meaning used by the SBA in 13 CFR 121.104(a).

What Debt Counts in Determining Maximum Loan Size: “Existing outstanding and undrawn available debt” is calculated as of the date of the loan application and includes all amounts borrowed under any loan facility as well as publicly issued bonds or private placement facilities. It also includes all unused commitments under any loan facility but excludes any undrawn commitment that:

- serves as a backup line for commercial paper issuance;

- is used to finance receivables (including seasonal financing of inventory);

- cannot be drawn without additional collateral; or

- is no longer available due to change in circumstance.

Additional information, details on the application process and documentation, and a start date for the program, are expected to be announced soon. Like with other programs implemented by the CARES Act, BCLP is tracking these developments closely.

[1] - See Federal Reserve, Term Sheet: Main Street New Loan Facility (April 30, 2020), https://www.federalreserve.gov/newsevents/pressreleases/files/monetary20200430a1.pdf; Federal Reserve, Term Sheet: Main Street Priority Loan Facility (April 30, 2020), https://www.federalreserve.gov/newsevents/pressreleases/files/monetary20200430a2.pdf;

Federal Reserve, Term Sheet: Main Street Expanded Loan Facility (April 30, 2020), https://www.federalreserve.gov/newsevents/pressreleases/files/monetary20200430a3.pdf (collectively, the “Term Sheets”).

[2] - See Federal Reserve, Main Street Lending Program: Frequently Asked Questions (April 30, 2020), https://www.federalreserve.gov/monetarypolicy/files/main-street-lending-faqs.pdf.

[3] - Businesses must be legally formed entities that are organized for profit as a partnership, limited liability company, corporation, association, trust, cooperative, joint venture (with no more than 49% participation by foreign business entities) or a tribal business concern. The FAQs also detail the requirements for a “tribal business concern” to qualify (see FAQ E.2.).

[4] - Ineligible Businesses include Businesses listed in 13 CFR 120.110(b)-(j), (m)-(s), as modified and clarified by SBA regulations for purposes of the PPP on or before April 24, 2020. Such modifications and clarifications include the SBA’s recent interim final rules available at 85 Fed. Reg. 20811, 85 Fed. Reg. 21747, and 85 Fed. Reg. 23450. The Fed may further modify the application of these restrictions to the MSLP.

[5] - A Business that has received a PPP loan is permitted to borrower under MSLP.

[6] - A MSELF upsized tranche must be secured if the underlying loan is secured—and any collateral securing the underlying loan must secure the upsized tranche on a pro rata basis. MSNLF and MSPLF loans are permitted to be secured as well.

[7] - The Fed is currently evaluating the feasibility of adjusting eligibility metrics of MSLP for borrowers that have asset-based loans.

[8] - The London Inter-Bank Offered Rate (“LIBOR”). The Fed initially announced that the interest rate would be based on “SOFR” - the Secured Overnight Financing Rate. After receiving feedback regarding implementation issues, the Fed switched the reference rate to LIBOR, with the recommendation that loan documentation should include fallback language in the event that LIBOR become unavailable during the term of the loan.

[9] - This means that a MSNLF loan may not be junior in priority to other unsecured loans. See the FAQ for further details.

[10] - A business that receives a loan or loan guarantee under Title IV of the CARES Act must agree that during the lifetime of such loan or guarantee, it will not pay total compensation (meaning salary, bonuses, award of stock, and other financial benefits) that exceeds the following limits:

- The total compensation during any consecutive 12 months for any officer or employee who made over $425,000 in 2019 may not exceed their 2019 total compensation, and severance or other benefits on termination of employment may not exceed twice their 2019 maximum total compensation.

The total compensation during any consecutive 12 months for any officer or employee who made over $3,000,000 in 2019 may not exceed the sum of $3,000,000, and 50% of the compensation the officer or employee received over $3,000,000 in 2019.