Insights

EU merger judicial review: where are we now after 02/Three?

Jul 06, 2020Summary

For almost as long as EU merger control has existed, scholars and practitioners have discussed and debated the European Commission’s (EC) split roles as investigator, prosecutor, judge, and jury under the EU Merger Regulation (EUMR). It wasn’t until the EU courts overturned three EC prohibition decisions due to manifest errors in assessment in the early 2000s that the discussion shifted to the undeniable need for reform. Accordingly, in 2004, many administrative and procedural amendments were introduced to the EUMR to simplify the procedure and enable the Commission to focus its resources more effectively on proposed problematic mergers. Despite these reforms and the ones that followed, there is still much discussion on further reforms and the conversation about competition policy and discretion is even more prevalent.

Even with a constantly reforming regime, the EUMR’s extensive vault of decisions has provided an assessment of diverse markets, essential guidance on transactions, and some insight into the competition authority’s approach. And, the EU courts continue to provide an independent review of the decisions taken by the EC. In regards to the judicial review of EC decisions, even for acts where the EC has a margin of discretion regarding economic matters, that does not mean that the EU courts must refrain from reviewing the EC’s interpretation of information of an economic nature. Not only must the EU courts, among other things, establish whether the evidence relied on is factually accurate, reliable and consistent, but also whether that evidence contains all the information which must be taken into account in order to assess a complex situation and whether it is capable of substantiating the conclusions drawn from it.

Additionally, when a company wishes to annul an EC merger decision, an application to the General Court (GC) will be admissible only if it requests the annulment of a reviewable act. For an EC decision to constitute a ‘reviewable act’ in the merger context, there needs to be a (1) substantive decision on the compatibility of a concentration with the internal market or (2) decisions taken during the procedure leading up to the final decision on a concentration. It is largely recognised that annulments are rare and in order to be successful in gaining an annulment, the party must show that the Commission: (1) lacks of competence/jurisdiction, (2) there was an infringement of an essential procedural requirement, (3) an infringement of the Treaties or of any rule of law relating to their application, or (4) a misuse of powers (Article 263 TFEU).

In 2017, the GC annulled two high-profile merger decisions – in one case outlining the Commission’s failure to properly assess vertical effects and in the other criticising the EC’s use of a substantially different econometric analysis in its decision than initially disclosed to the parties in the other case. Perhaps most notably and recently, on May 28, 2020, the GC comprehensively overturned the Commission’s 2016 decision to block the proposed acquisition of Telefónica Europe Plc (O2) by CK Hutchison Holdings Ltd /Hutchison 3G UK Ltd (Three) in CK Telecoms UK Investment Ltd v European Commission (Case T-399/16) (O2/Three). Among other things, the Court reinforced the importance of the law and the risks arising from the EC’s wide discretion. In the judgment, the Court highlighted the Commission’s failure to show that Three was an ‘important competitive force’ or that O2 and Three were close competitors before the transaction. Notably, for the first time since the ‘significant impediment to effective competition’ (SIEC) was introduced in the EUMR’s 2004 reforms, the European court shed some light on the substantive criteria. Specifically, the GC notes that the EC must produce sufficient evidence to demonstrate with strong probability the existence of a SIEC. And the GC makes it clear that the standard of proof which lays with the EC is higher than ‘more likely than not’ but not as high as ‘balance of probabilities.’ Overall, the GC’s scrutiny and rejection of EC’s analysis on various points will likely be welcome by other parties who have pending appeals to EC decisions in which the EC relied on similar analyses. The EC has two months to appeal the GC decision. However, if not appealed or overturned by Europe’s highest court, this case will undoubtedly set an important precedent in European merger control.

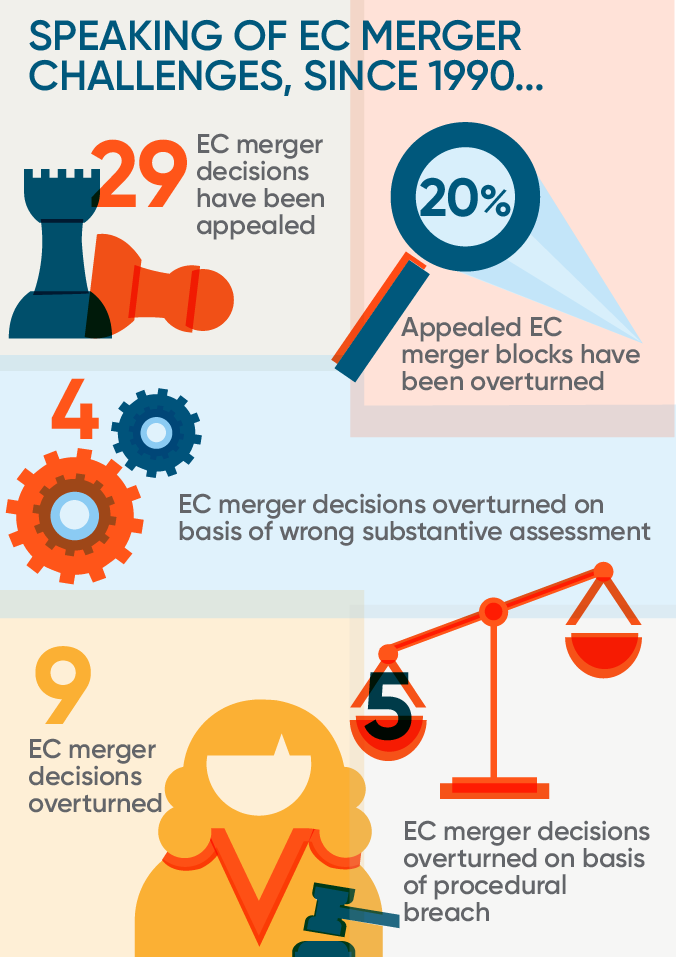

Despite these examples of EC decisions being overturned, it remains very rare for EC merger decision to be appealed, with only 29 decisions being appealed out of a total of over 7,700 notified cases since 1990 – indeed, in most instances, the value of a transaction will have long been lost by the time the appeal process is exhausted, leaving the parties with little incentive to go appeal. Of those few cases that are appealed, it also remains the exception for the decision to be overturned. In light of Three/O2, here are a few statistics that summarise the EUMR appeal landscape:

With every layer we add to the economic environment, there will likely be a conversation that follows about the need for more reform in competition policy. Even with the uncertainty that is yet to come, one thing is apparent, the GC’s latest decision has reinforced the law and cast doubts on the EC’s approach to applying its wide discretion under the EUMR.

This article was co-authored by trainee solicitor Philip Apfel.