Insights

UK - Covid-19 - BCLP Retail Insight: The Week That Was, Vol 9

Oct 26, 2020Summary

This week, the BCLP Retail team discuss the latest round of government restrictions to reduce the spread of Covid-19, and offer an updated timeline of relevant measures. We look at potential uses of empty retail space and analyse the effects of the pandemic on store closures. Lastly, we look at a government proposal for retailers to provide free public cashback services.

Tighter Restrictions, Tighter Belts?

October 15 saw tighter restrictions imposed by the Government for London, Essex and York, which are now classified as ‘Tier 2’, or ‘High Risk’. From October 24, Stoke-on Trent, Coventry and Slough are also Tier 2. This means a bar on socialising indoors with non-household members, the “rule of six” outdoors and reduced use of public transit. At the date of writing, Liverpool, Lancashire, South Yorkshire and Greater Manchester are now Tier 3, or “Very High Risk”, which means a prohibition on non-household social gatherings outdoors as well as the closure of some hospitality and leisure venues. Unlike the national lockdown, non-essential retailers have not been instructed to close, but reduced mobility and restrictions on socialising indoors, outdoors and in limited group size, has the potential to suppress footfall for bricks and mortar retailers. In Wales, a 17-day “firebreak” lockdown began at 6pm Friday, seeing the shuttering of restaurants, pubs, and non-essential shops, with supermarkets also told to stop selling non-essential items, like clothes and toys.

Preaching to the Converted

We have previously discussed how the pandemic has intensified the already-existing challenges faced by retailers, epitomised by empty storefronts on high streets across the country. Continuing demand for housing in the UK means retail-to-residential conversion may offer an economically viable solution for surplus retail space. Both retail landlords and Build to Rent operators are assessing potential opportunities, albeit these are more likely to be feasible in urban areas offering additional complimentary services to potential tenants.

Record closures in the first half of 2020

In the first half of 2020, thousands more chain retailers closed permanently than during the same period in 2019. These record closure rates reflect the impact of the pandemic on the increasing popularity of e-commerce. Not surprisingly, demand for logistics space is higher than ever. However, the outlook for bricks-and-mortar stores is not all bleak; during the first six months of this year, more shops opened than during the first six months of the previous year. The type of shops that are successful in this economic climate are those offering services that do not easily translate to the online marketplace, including tradespeople’s outlets (such as locksmiths, tailors, or construction supply shops).

Cash Me If You Can

Means of payment, as well the physical act of shopping, are transitioning from physical to electronic at an accelerating rate. In recent years, the number of free-to-use cash machines has diminished, as fewer people use cash in their day-to-day lives. The Government is currently consulting on new proposals to protect those reliant on cash payments (often low income and/or elderly individuals). These proposals would see retailers’ tills effectively become ATMs, allowing people to withdraw cash from retailers without any concurrent obligation to purchase anything. The responsibility of providing cash services offers retailers a potential increase in foot traffic, but also an increase in risk from holding more cash.

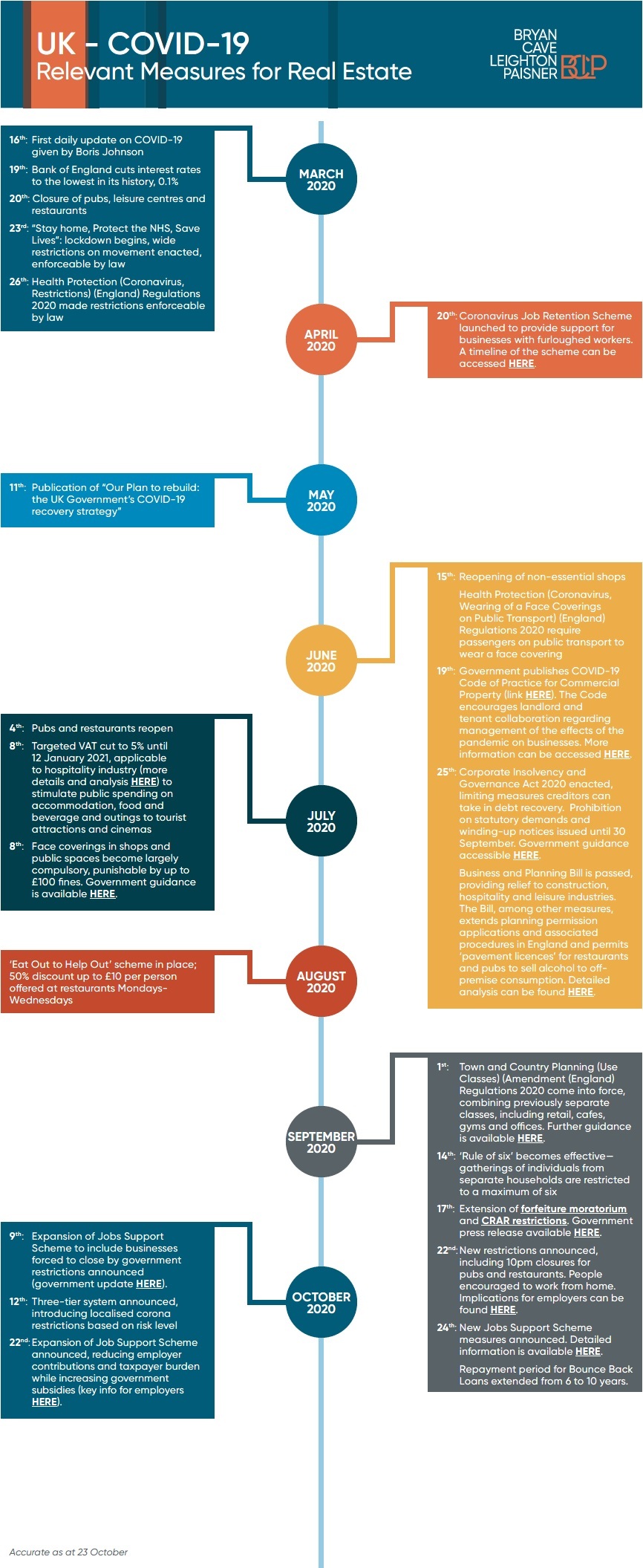

Updated Timeline of Real Estate Relevant Covid-19 Measures

This timeline is accurate as of October 23, and will be updated on a rolling basis.

Please do get in touch with the BCLP Retail Team if you have any queries regarding the topics raised in this bulletin. This bulletin was co-written with Trainee Solicitor Madeleine Lofchy.

Related Practice Areas

-

Real Estate

-

Real Estate Sector

-

Real Estate Retail

-

Retail & Consumer Products