Insights

UK - Covid-19 - BCLP Retail Insight: The Week That Was, Vol 10

Nov 06, 2020Summary

This week, the BCLP Retail team look at the impact of the four week lockdown for England and extension of furlough, review the scale of shop closures and key findings in LDC’s latest retail market analysis report, and discuss the proposed regulations of pre-pack administrations involving greater government scrutiny. We also include an updated timeline of sector-relevant measures in response to the pandemic.

Lockdown 2.0

In an effort to slow the spread of the pandemic before the Christmas season, the Government announced a new national 4 week lockdown in England from Thursday 5 November. Non-essential retailers, restaurants and bars have had to shut their doors, although click and collect is still permitted outside of stores. This will inevitably have a devastating financial impact on retailers as the 2 months between Halloween and Christmas are normally the most lucrative for them. Many shops will be forced to rely on online ordering and deliveries, so smaller independent retailers that don’t have this infrastructure will feel the effects of the lockdown even more keenly. The expected shift to online shopping will test the capacity of logistics and delivery networks. The lockdown may also put a further strain on landlord and tenant relationships as retailers again seek concessions to weather the storm.

Furlough Extension

The Government has also announced an extension of their furlough scheme until March, which will pay up to 80% of furloughed employees’ wages to a cap of £2,500 a month. The scheme was due to end on 31 October, but has been extended in light of the second lockdown. The scheme will be available to all UK businesses and PAYE employees. It is expected that retail take-up of the extension will be high, as government data revealed that by June retail businesses had claimed £3.3 billion to fund furloughed employees, comprising the salaries of 1.6 million workers. Some retailers have already indicated that they intend to furlough all shop based workers, and it is hoped that the scheme will reduce the need for further mass redundancies.

LDC’s Retail and Market Analysis for H1 2020

The Local Data Company released its Retail and Market Analysis for H1 2020 on 4 November which covers the period January to August 2020. The report details the impact of the pandemic with a net loss of 7,834 units, the highest for H1 since 2014 with 31,139 shop closures and a 13.2% increase in vacancy rates. The key findings in the report point to a migration to online retailing; the potential for repurposing, especially of retail parks; the resilience of the independent retailers; the move to local retailing; and the ongoing challenges for the leisure sector.

Pack it up: Tighter Restrictions for Pre-pack Administrations?

Exacerbated by the pandemic, an increasing number of retailers have entered into pre-pack deals, (the process through which a company is put into administration and its business/assets are immediately sold by the administrator under a sale arranged before the administrator was appointed). Under this process, the directors or former owner of an insolvent company can create a new company and arrange for the sale of the business/assets to that new company, garnering criticism for the lack of transparency vis-à-vis the insolvent company’s creditors and potential for conflicts of interest. These arrangements are now facing greater scrutiny—with the Government having recently published draft regulations, which, if adopted in their current form, will require pre-pack administrations involving a sale of all or a substantial part of a company’s assets to “connected parties” within 8 weeks of the date of the company’s entry into administration to be reviewed by an independent third party or approved by the company’s creditors. The third party reviewer must be independent from the connected party purchaser, the company and the administrator, and will set out in a written report whether or not the consideration to be provided for the relevant property, and the grounds for disposal, are reasonable in the circumstances.

Landlords have reacted with cautious optimism, as the requirement to involve an independent third party reviewer (or the company’s creditors) could ameliorate some of the criticisms of pre-pack sales (albeit that where the independent consultant’s report states the case is not made for the disposal, the administrators can still proceed with the disposal notwithstanding, but will be required to provide a statement setting out the reasons for doing so. Note these measures do not extend to CVAs, which have also become increasingly common for retailers in the past few months. It is currently expected that the regulations will be laid before Parliament when time allows in early 2021, with a view to the new requirements coming into force next Spring.

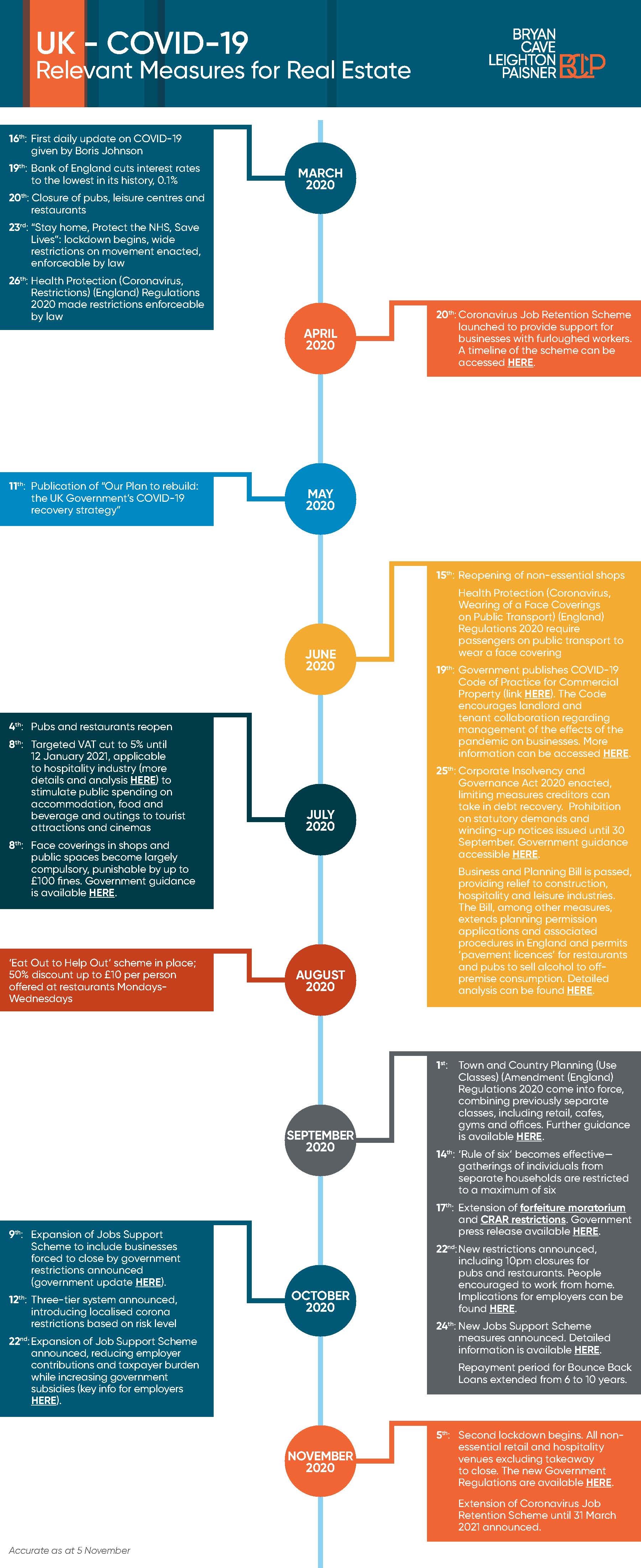

Updated Timeline of Real Estate Relevant Covid-19 Measures

This timeline is accurate as of November 5, and will be updated on a rolling basis.

Please do get in touch with the BCLP Retail Team if you have any queries regarding the topics raised in this bulletin. This bulletin was co-written with Trainee Solicitors Madeleine Lofchy and Naomi Hoggett.

Related Practice Areas

-

Real Estate

-

Real Estate Retail

-

Real Estate Sector

-

Retail & Consumer Products