BCLPSecCorpGov.com

That was NOT fast – SEC adopts pay-versus-performance disclosure requirements for upcoming proxy season

Aug 29, 2022More than seven years after their original proposal, the SEC adopted new rules requiring companies to disclose metrics reflecting the relationship between executive compensation actually paid and the company’s financial performance. Mandated by the Dodd-Frank Act in 2010, the rules were passed on August 25, 2022 by a divided 3-2 vote.

The rules will apply to all reporting companies, except foreign private issuers, registered investment companies and Emerging Growth Companies. As discussed below, Smaller Reporting Companies will be permitted to provide scaled disclosures.

The rules become effective 30 days after publication in the Federal Register. Companies must begin to comply in proxy statements that include specified executive compensation disclosure for fiscal years ending on or after December 16, 2022. Accordingly, December 31 fiscal year-end companies should begin planning now to address the new disclosure requirements in proxy statements for 2023 annual meetings.

New required tabular disclosure

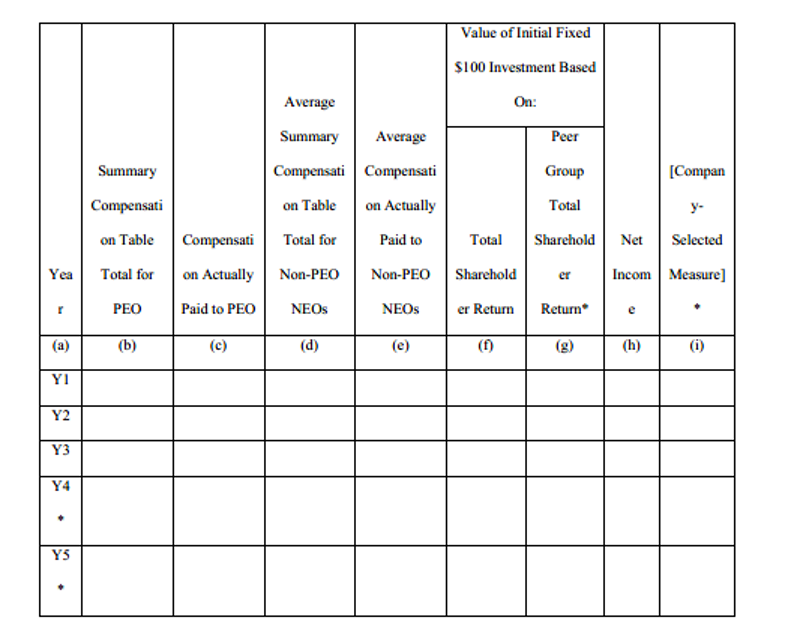

Although given flexibility as to location in proxy statements, companies must provide the following tabular disclosure:

(Image from Adopting Release)

The new table calls for disclosure of the specified metrics for the last five completed fiscal years:

- “Executive compensation actually paid” (as defined below) for the CEO and, as an average, for the other named executive officers (NEOs).

- Footnotes are required to show:

- the amounts deducted from or added to Summary Compensation Total (SCT) amounts in columns (c) and (e) to calculate those in columns (d) and (f)

- the individual NEOs whose compensation is included in the average for each year

- Separate columns are required for years where the company had multiple CEOs

- Footnotes are required to show:

- Three financial performance measures:

1. Total shareholder return (TSR) for (x) the company and (y) the company’s peer group (weighted by stock market capitalization at the beginning of each period for which a return is indicated)

Companies may use either the same peer group used for the Performance Graph or one used in CD&A for discussion of compensation benchmarking practices. If the peer group is not a published industry or line-of-business index, the members of the group must be disclosed in a footnote or, if previously disclosed in SEC filings, by incorporation by reference to those filings.

As with the Performance Graph, if a company changes the peer group from the one used in the previous fiscal year, it will only be required to include tabular disclosure of peer group TSR for that new peer group (for all years in the table), but must explain, in a footnote, the reason for the change, and compare the company’s TSR to each of the old and new groups.

2. The company’s net income

3. A financial performance measure selected by -- and specific to -- the company that, in its judgment, represents the most important financial performance measure used to link compensation actually paid to NEOs to company performance for the most recently completed fiscal year.

The company-selected measure must not be one otherwise required to be included in the table. As with CD&A, if a company-selected measure is non-GAAP in nature, those rules will not apply but the company must disclose how the number is calculated from its audited financial statements.

Dissents criticize stale economic analysis and “unnecessarily complicated” requirements

Two Commissioners dissented from the rulemaking:

Peirce criticized the rule as “unnecessarily complicated” and believes the SEC should have taken a “principles-based” approach. She noted that the SEC itself acknowledged that the rule will not provide significant benefits, since companies already provide a detailed CD&A discussion of the material elements of executive compensation. Further, she believes “the fundamental variation across companies’ compensation practices and the underlying assumptions some of the disclosures necessitate will render the new presentation anything but clear and comparable.” In addition, she expressed concern that the rule “could distort how public companies compensate executives and how investors evaluate companies’ compensation decisions.”

Uyeda criticized the SEC for failing to update the seven-year old economic analysis and related cost-benefit discussion – particularly in light of 10-12 year old equity award data used and the general move by companies away from use of stock options and pension plans. He also criticized the SEC’s reliance on a 16-year old hourly billing rate of $400 for outside professional advisors used by companies.

Calculation of “executive compensation actually paid”

The rules call for disclosure of total compensation as reported in the SCT, modified to adjust the amounts included for pension benefits and equity awards as follows:

- deduct from the SCT total compensation the aggregate change in the actuarial present value of all defined benefit and actuarial pension plans;

- add back the aggregate of two components:

(1) actuarially determined service cost for services rendered by the executive during the applicable year (the “service cost”); and

(2) the entire cost of benefits granted in a plan amendment (or initiation) during the covered fiscal year that are attributed by the benefit formula to services rendered in periods prior to the plan amendment or initiation (the “prior service cost”), in each case, calculated in accordance with GAAP;

- deduct from the SCT total compensation the equity award amounts;

- add back the “fair value” of equity awards granted in the covered fiscal year that are outstanding and unvested as of year-end, with changes in value reported from year to year until vesting (or the date the company determines the award will not vest), and further adjustments for dividends or earnings and forfeited awards

The SEC considered but decided not to exclude from the SCT total compensation the above-market or preferential earnings on deferred compensation that is not tax qualified or unvested amounts of deferred compensation that is not tax qualified.

Footnotes would be required for any valuation assumptions that materially differ from those disclosed at the time of grant.

The SEC acknowledged that requiring fair value calculations for each equity award on a date other than the grant date may be burdensome but believes that the concept is not novel, as GAAP requires re-valuation of modified awards.

Calculation of TSR

As with the Performance Graph, TSR should be calculated on a cumulative basis measured from the market close on the last trading day before the fiscal year in the table through and including the end of the fiscal year for which TSR is being calculated (i.e., the TSR for the first year in the table will represent the TSR over that first year, the TSR for the second year will represent the cumulative TSR over the first and the second years, etc.). Both TSR and peer group TSR should be calculated based on a fixed investment of one hundred dollars at the measurement point.

Description of relationships between metrics

Companies will need to describe the relationships between each of the financial measures and the executive compensation included in the table, as well as between the TSR and its peer group TSR. The descriptions may be graphical, narrative or a combination, and – if “clear” – may be grouped together.

List of top financial performance measures used to link compensation actually paid to company performance

Companies will need to provide an unranked list of three to seven financial performance measures that it determines are its most important measures (using the same approach as taken for the company-selected measure) – based on the last fiscal year (not the past five years).

They will be permitted, but not required, to include non-financial measures in the list if they considered such measures to be among their three to seven “most important” measures. Companies may do so only if they have disclosed at least three (or fewer if the company only uses fewer) financial measures and the list may only include a maximum of seven measures.

The disclosure may be provided either as one list or as two separate lists for each of the CEO and all other NEOs or as multiple lists for each of the officers included in the table.

Companies are not required to provide the methodology used to calculate the measures, but the SEC believes it should be considered if needed to prevent the disclosure from being confusing or misleading. Further, companies may cross reference to other disclosures in the proxy statement that describe their processes and calculations in determining NEO compensation as relates to these performances measures, if they choose to do so.

Supplemental disclosures

Companies may voluntarily include additional measures of compensation or financial performance or other disclosures, so long as the disclosure is identified as supplemental, not misleading and not presented with greater prominence than required disclosures. For example, companies that do not use TSR in setting compensation may elect to explain any misalignment between compensation and TSR.

Inline XBRL

Companies will be required to use Inline XBRL to tag their pay versus performance disclosure.

Not incorporated into filings

The rules provide that the required information will not be deemed to be incorporated by reference in any Securities Act or Exchange Act filing, except to the extent the company specifically does so.

Transition period

Companies, other than SRCs, will be required to provide the information for three years in the first proxy or information statement in which they provide the disclosure, adding another year of disclosure in each of the next two annual proxy statements.

SRCs will initially be required to provide the information for two years, adding an additional year of disclosure in each next annual proxy or information statement. In addition, an SRC will only be required to provide the required Inline XBRL data beginning in the third filing in which it provides pay versus performance disclosure, instead of the first.

The pay-versus-performance disclosure would only need to be provided for years in which a company was an SEC reporting company.

Required disclosure for smaller reporting companies

SRCs will:

- Only be required to present three, instead of five, fiscal years of tabular disclosure;

- Not be required to disclose amounts related to pensions for purposes of disclosing executive compensation actually paid;

- Not be required to present peer group TSR or a company-selected measure or a tabular list;

- Be permitted to provide two years of data, instead of three, in the first applicable filing after the rules became effective; and

- Be required to provide disclosure in the prescribed table in XBRL format beginning in the third filing in which it provides pay-versus-performance disclosure.

Related Capabilities

-

Securities & Corporate Governance