BCLPSecCorpGov.com

SEC adopts big changes to Rule 10b5-1 plan requirements; reaffirms warning about “insider gifting”

Dec 15, 2022On December 14, 2022, the SEC unanimously adopted significant changes to the requirements for Rule 10b5-1 trading plans, one day shy of the anniversary of its proposals, including:

- Cooling-off periods for officers and directors of at least 90 days (but not more than 120 days) or 30 days in the case of other insiders

- Prohibition on overlapping plans

- Only one so-called “bullet” plan every 12 months

- Certifications by insiders

- Good faith requirement in the establishment of a trading plan

- Increased disclosure requirements in periodic reports for trading plans, equity grant policies and insider trading policies

- Form 4 reporting of stock gifts within two business days, with the SEC reaffirming its cautionary guidance regarding “insider gifting”.

The final rules largely track the proposals discussed in our December 16, 2021 client alert, except that, in response to a number of comments from the business community, the SEC:

- Relaxed the mandatory cooling-off periods for officers, directors and other insiders

- Dropped any required cooling-off period or restriction on overlapping or bullet plans for issuers

- Added several exceptions to the prohibition on overlapping plans and restrictions on bullet plans

- Changed the certification by officers and directors to require its inclusion in the trading plan

- Reworded the “good faith” requirement

- Exempted pricing information from required quarterly disclosures of trading plans

- Narrowed the window and triggers for tabular disclosure of equity grants proximate to release of material nonpublic information

Although adopted unanimously, Commissioners Peirce and Uyeda expressed reservations about certain aspects of the final rule, including the length of the cooling off period, the “unnecessary” condition for the individual to have “acted in good faith with respect to” the plan, “unnecessary” tabular disclosure requirements about awards of options, the requirement to file insider trading policies on Edgar instead of allowing website posting, “unreasonable” Form 4 deadlines for gifts, the absence of a financial hardship exemption, and the failure to allow trading if MNPI becomes public before the trade.

Effective date

The final rules will become effective 60 days following publication of the adopting release in the Federal Register. Section 16 reporting persons will be required to comply with the amendments to Forms 4 and 5 for beneficial ownership reports filed on or after April 1, 2023. Issuers will be required to comply with the new disclosure requirements in Exchange Act periodic reports on Forms 10-Q, 10-K, and 20-F and in any proxy or information statements in the first filing that covers the first full fiscal period that begins on or after April 1, 2023. The final amendments defer by six months the date of compliance with the additional disclosure requirements for smaller reporting companies.

Key changes to 10b5-1 requirements

The amendments add new conditions to the availability of the Rule 10b5-1(c)(1) affirmative defense to insider trading liability, including:

- Cooling-off period for Section 16 insiders. 10b5-1 trading arrangements entered into by Section 16 officers or directors will need to include a cooling-off period -- before the first trade -- of the later of: (1) 90 days following plan adoption or modification or (2) two business days after filing the 10-Q or 10-K (or, in the case of foreign private issuers, disclosure of financial results in 20-F or 6-K) for the fiscal quarter in which the plan was adopted or modified. In response to comments, the final rules reflect the relaxation of the requirement from a rigid 120-day requirement in the proposal.

- The “later of” test means that, if an insider adopts a plan 15 days before the end of a quarter and the company files its 10-Q within 30 days after such quarter, the cooling off period will be 90 days from the date of adoption.

- If financial results are disclosed more than 120 days after plan adoption, 120 days is the maximum length of the cooling-off period.

- Only certain modifications trigger a new cooling-off period: those that change the amount, price or timing of the purchase or sale of the securities (or a change to a written formula or algorithm or computer program that affects the amount, price, or timing of the purchase or sale of the securities).

- Cooling-off period for other insiders. 10b5-1 trading arrangements entered into by insiders other than Section 16 officers or directors or issuers will need to include a 30-day cooling-off period before the first trade, including after any modification of a plan.

- In response to comments, the SEC decided not to require a cooling-off period for issuers, noting, however, that it is considering whether rule changes are needed in the context of proposed amendments to Rule 10b-18.

- Certification of non-awareness in plan document. Any Section 16 officer or director must include in the plan document his or her certification that (1) they are not aware of material nonpublic information about the issuer or its securities and (2) they are adopting the plan in good faith and not as part of a plan or scheme to evade antifraud rules.

- The rule allows inclusion of the certification in the plan instead of separate documentation, and does not include the 10-year retention requirement as originally proposed.

- In the SEC’s view, because “it is sufficiently clear that the certification would not create an independent basis of liability for insider trading,” it declined to amend the rule to include that express statement.

- Overlapping plans and single-trade arrangements ineligible, except by issuers. The Rule 10b5-1 defense will not apply to multiple overlapping Rule 10b5-1 plans or plans, whether or not in the same or different classes of securities of the company. This provision applies to all persons other than the issuer, not just officers and directors.

- The restriction will not apply to plans not involving open market transactions, such as employee stock ownership plans or dividend reinvestment plans.

- The SEC adopted several modifications in response to comments:

- An insider may have separate contracts with multiple brokers treated as a single plan, provided such contracts, when taken together as a whole, satisfy the Rule.

- A broker may be replaced under a plan as long as the purchase or sales instructions for the original and new brokers are identical, including with respect to prices of securities, trade dates and amounts of securities.

- Two separate plans may be maintained at the same time (other than by the issuer) so long as trading under the later-commencing plan is not authorized to begin until after all trades under the earlier-commencing plan are completed or expire without execution. Further, a cooling-off period is required to begin on the date of termination of the earlier-commencing plan.

- “Sell-to-cover” plans will not disqualify another otherwise valid plan, so long as the former only authorize qualified sell-to-cover transactions, i.e., instructions for an agent to sell only such securities as are necessary to satisfy tax withholding obligations at the time of vesting of a compensatory award (such as restricted stock or SARs but excluding stock option awards), and the insider does not otherwise influence the timing of sales.

- Only one single transaction Rule 10b5-1 plan (or “bullet” plan) every 12 months, except by issuers. The Rule 10b5-1 defense for plans “designed to effect” to effect an open-market purchase or sale of the total amount of securities in a single transaction would be limited to one plan per 12-month period. This provision applies to all persons other than the issuer, not just officers and directors.

- According to the SEC, a plan is “designed to effect” trades as a single transaction when the plan “has the practical effect of requiring such a result.” By contrast, that’s not the case where the plan gives the agent discretion over whether to trade as single transaction or trades are dependent on events or data not known at the time a plan was established and it is reasonably foreseeable that the plan might result in multiple transactions.

- As above, plans authorizing qualified sell-to-cover transactions are not subject to this requirement.

- Good faith requirement extended. 10b5-1 trading arrangements must not only be entered into in good faith, but the person establishing the plan must also have “acted in good faith with respect to” the plan.

- The SEC changed the requirement from the proposal that the plan must be “operated” in good faith in response to concerns of commenters regarding the ambiguity of that standard.

- In response to questions regarding trading halts by issuers, such as during merger negotiations, the SEC stated that cancellations directed by the issuer and outside the control or influence of the insider “may not, by themselves, implicate the good faith condition.”

Increased Disclosure Requirements

The new rules will require increased issuer disclosure regarding Rule 10b5-1 trading arrangements as well as option or option-like equity grants, and issuer insider trading policies and procedures, including:

- Quarterly disclosure of 10b5-1 and other trading plans. New S-K Item 408(a) will require issuers to disclose quarterly in periodic reports, using Inline XBRL, the adoption and termination of Rule 10b5‑1 trading arrangements and other pre-planned trading arrangements (whether or not compliant with Rule 10b5-1) by directors or officers (but not issuers), and the material terms of such trading arrangements.

- Disclosure should include names and titles, date of adoption or termination, duration and amounts of securities – but need not address pricing.

- Plans must be identified as either Rule 10b5-1 or non-Rule 10b5-1 (as defined) arrangements.

- Modifications are deemed both the termination of an existing plan and adoption of a new one for this purpose, pursuant to amended Rule 10b5-1.

- Annual disclosure of insider trading policies. New S-K Item 408(b) will require issuers to disclose, using Inline XBRL, in its annual reports on Form 10-K or 20-F and proxy and information statements (1) whether or not (and if not, why not) the issuer has adopted insider trading policies and procedures and (2) if adopted, such trading policies and procedures.

- The new rules do not require disclosure of the policies and procedures in the document, but instead permit filing those policies and procedures as an exhibit to the 10-K or 20-F.

- The SEC indicated that the disclosure “would address not only policies and procedures that apply to” purchases and sales “but also other dispositions” where material non-public information “could be misused, such as through gifts of such securities.” The SEC repeated its earlier cautionary note about the timing of gifts of securities, stating that the Exchange Act does not require that a “sale” of securities be for value and, in footnote 257, that:

“[A] donor of securities violates Section 10(b) if the donor gifts a security of an issuer in fraudulent breach of a duty of trust and confidence when the donor was aware of material nonpublic information about the security or issuer, and knew or was reckless in not knowing that the donee would sell the securities prior to the disclosure of such information. The affirmative defense under Rule 10b5-1(c)(1) is available for planned securities gifts.”

- New 10b5-1 checkbox requirement for Forms 4 and 5. The new rules require Section 16 officers and directors to disclose by checking a box on Forms 4 and 5 whether a reported transaction was made pursuant to a plan that is “intended to satisfy the affirmative defense conditions” of Rule 10b5-1(c).

- Filers will be required to provide the date of adoption of the trading plan, and will have the option to provide additional relevant information about the transaction.

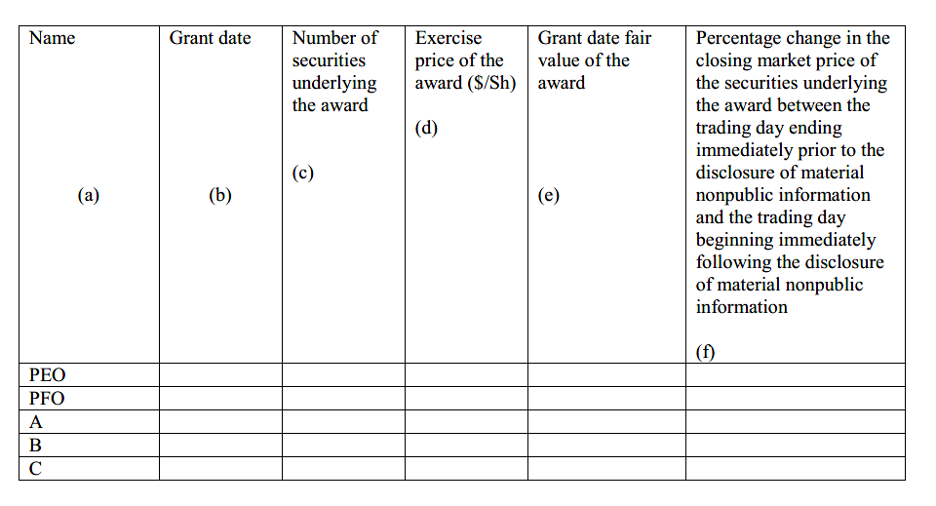

- Annual disclosure of option grant policies and new tabular disclosure. New S-K Item 402(x) will require an issuer to disclose in its annual reports on Form 10-K and proxy and information statements, using Inline XBRL, its grant policies and practices for options, SARs and similar instruments. Additionally, if, during the last fiscal year, an issuer has made grants to NEOs within four days before or one day after the release of material non-public information – e.g., the filing of a periodic report or the filing or furnishing of a current report on Form 8-K that contains material nonpublic information -- the issuer must disclose in its annual reports on Form 10-K and proxy and information statements specified details about those grants in the following tabular format, including the percentage change in the market value of the securities underlying the award between those dates:

(Image from Adopting Release)

-

- The final rule made several changes to the required table:

- The window for tabular disclosure was narrowed from 14 days before or after, to four days before or one day after, the release of material non-public information.

- Share repurchases and an 8-K reporting only the grant of a material new option award will not trigger tabular disclosure.

- The last column consolidates the two columns in the original proposal.

- The new rules require narrative disclosure about an issuer’s grant policies and practices for options and option-like instruments (such as SARs and similar instruments) regarding the timing of grants and the release of material nonpublic information, including how the board determines when to grant options and whether, and if so, how, the board or compensation committee takes material nonpublic information into account when determining the timing and terms of an award.

- The final rule made several changes to the required table:

- Faster reporting of gifts. The new rules will require Section 16 insiders to disclose bona fide gifts of securities on Form 4 within two business days.

- The SEC reaffirmed its cautionary guidance regarding insider gifting:

“[W]e agree with the academic authors, cited in the Proposing Release, who observe that a gift followed closely by a sale, under conditions where the value at the time of donation and sale affects the tax or other benefits obtained by the donor, may raise the same policy concerns as more common forms of insider trading. As these academic authors have found, because the donor is in a position to benefit from the asset’s value at the time of donation and sale, the donor may be motivated to give at a time when donor is aware of material nonpublic information and may expect the donee to sell prior to the disclosure of such information. Investors cognizant of this dynamic may be more reluctant to trade. We also agree with the academic authors that a gift made with the knowledge that the donee will soon sell can be seen as in effect a sale for cash followed by gift of the cash.” [Footnotes omitted]

- The SEC reaffirmed its cautionary guidance regarding insider gifting:

-

- The SEC confirmed that Rule 10b5-1 can be available for bona fide gifts of securities, noting that, in its view, the terms “trade” and “sale” include bona fide gifts.

Recommended Actions

- Review existing 10b5-1 plans of insiders and other employees, and confirm that the company is aware of all such plans

- Consider including a new question in annual D&O questionnaires addressing whether directors and officers have adopted any 10b5-1 plans, and reminding them to inform appropriate company personnel if such a plan is adopted going forward

- Review policies for 10b5-1 plans for conformity to the new rules

- Review grant policies and practices for options, SARs and similar instruments, and if necessary, adopt such policies in written, disclosable form

- Evaluate existing policies for gifts in light of the SEC’s cautionary guidance and their increased visibility under the new Form 4 two-business day reporting requirement, and consider any changes to internal processes to capture and report this information

- Consider training for directors and officers regarding the new rules, in order to highlight the changes, including how the new rules for reporting gifts, and SEC guidance, might affect charitable giving plans

- Consider implications of required disclosures of trading plans, including share amounts and durations

For further information on this topic, please contact Randy Wang, Rob Endicott or any other BCLP Securities and Corporate Governance lawyer. Additional resources are available on our website for the BCLP Securities and Corporate Governance Practice. Bryan Cave Leighton Paisner LLP makes available the information and materials in its website for informational purposes only. The information is general in nature and does not constitute legal advice. Further, the use of this site, and the sending or receipt of any information, does not create any attorney-client relationship between us. Therefore, your communication with us through this website will not be considered as privileged or confidential.

Related Capabilities

-

Securities & Corporate Governance