Insights

Public takeovers in the UK real estate sector

May 30, 2023Summary

BCLP has analysed all of the completed and ongoing public takeover transactions in the UK real estate sector since the beginning of 2019.[1]Deal activity during that period has been consistently strong, with 15 completed transactions and three currently ongoing.[2]

Our analysis has identified two principal categories into which these transactions fall.

Mergers (including mergers of equals) – pursuing the benefits of scale

The first category concerns mergers of similar or complementary businesses.

The merger of Secure Income REIT (SIR) and LXi REIT, on which BCLP advised SIR in 2022, resulted in the combination of two sector-diversified long-income specialists, with complementary portfolios, creating a market-leading REIT in this sub-sector with a property portfolio valued at nearly £4 billion.

The merger of Capital and Counties (Capco) and Shaftesbury, also in 2022, had similar characteristics. Both companies operated in central London, with Capco being focussed on Covent Garden and Shaftesbury on the West End. This deal therefore brought together two adjacent property portfolios, with a combined value of £5 billion, under common ownership. With limited overlap between the occupiers of the respective businesses, the combination increased the tenant diversity of the combined group.

The all share merger between Primary Health Properties and MedicX Fund in 2019 brought together two similar and complementary portfolios with little geographic overlap.

Greater scale was an important factor in all of these transactions. The benefits of increased scale typically include greater share liquidity, stronger combined balance sheets and access to alternative forms of debt finance from a wider pool of providers. It is usual for cost savings and efficiencies to be identified (through the rationalisation of corporate and administrative expenses and possibly lower management fees) so these transactions are also accretive to earnings either immediately or in the relatively short term.

There may also be other issues which are addressed through this type of transaction. For example, LondonMetric’s 2019 acquisition of A&J Mucklow provided a solution to succession planning issues at Mucklow, while also accelerating LondonMetric’s strategy to increase exposure to distribution and long income assets. Workspace Group’s 2022 takeover of McKay also allowed an acceleration of Workspace’s growth strategy.

It should be noted that on 23 May 2023, shortly before the publication of this article, London Metric announced an all-share offer for CT Property Trust in a recommended transaction valued at £198 million and which is consistent with the themes described above.

The impact of private capital

The second dominant trend driving takeover activity in the UK REIT market has been private equity real estate (PERE) take privates.

Blackstone, by some distance the world’s largest real estate investor, has been behind the majority of these deals since the beginning of 2019, including the ongoing offer for Industrials REIT (on which BCLP is advising Industrials REIT) and Blackstone’s previous successful offers for St Modwen in 2021 and Hansteen Holdings in 2019.

Blackstone was also involved in the successful takeover of GCP Student Living by Scape Living and iQSA Holdco. In that deal, Scape (a global operator and developer of purpose-built student accommodation, backed by APG) and iQ (a provider of UK PBSA and owned by Blackstone) effectively carved up GCP’s portfolio of assets to accelerate the growth of their respective businesses in a deal valued at £969 million.

Starwood, another PERE investor, has also transacted in this market, in 2021 acquiring RDI REIT, in which it already had a shareholding of approximately 29.5 per cent.

In our experience, there was historically some reluctance among PERE firms to make public takeover bids. However, the process now appears to be much better understood, with PERE investors weighing the upside of being able to acquire a potentially large portfolio of assets in a single deal, rather than acquiring assets on a piecemeal basis, against any concerns about the potential complexities and public nature of a process under the Takeover Code and the potential lack of deal certainty.

For target companies and their shareholders, take privates can also be compelling.

After a long period during which the shares of many property companies traded at a premium to net asset value, the listed property sector is currently out of favour, as a result of various factors including rising interest rates, inflation and concern over debt availability and pricing. Share prices are therefore depressed, with almost all listed property companies trading at a discount to the value of their net assets. This makes equity issuance difficult or even impossible, which stymies growth plans.

Therefore, an all cash offer, usually at a substantial premium to the prevailing share price, can be appealing. This allows shareholders to cash out at an attractive valuation and potentially generates a significant profit for institutional investors whose investments in listed companies are marked to market (i.e. carried in their books at the stock market valuation).

There are also potential upsides for the target as it allows the development of the business – possibly with the same management team – with the backing of private capital and without concerns about short-term share price performance, the discount to NAV and the other perceived negative aspects of public equity markets. This is particularly relevant in the current context of tighter credit markets, when access to alternative sources of capital may be particularly attractive.

Furthermore, private equity firms may take a highly strategic view, making big bets on macro themes (such as Blackstone’s huge push into logistics) or identifying opportunities to acquire large portfolios that have strategic value to them or their other portfolio companies. They may consequently see value-creation opportunities which make current share prices and traditional property valuations of less relevance, allowing them to make what can be seen as a “knockout” offer.

Schemes of arrangement are the go-to deal structure

Public M&A transactions in the real estate sector are almost invariably structured as schemes of arrangement. This delivers full control of the target company immediately upon the scheme becoming effective, following the approval of the necessary majority of target shareholders at a shareholder meeting and satisfaction of any other required conditions. There is no need to “squeeze out” minority shareholders and even shareholders who vote against the transaction are bound by it if it is approved.

Looking ahead

The universe of listed real estate investment companies in the UK has shrunk by 20 per cent since the beginning of 2019, from 83 listed property investment companies at the beginning of 2019 to 66 today. During this period there have been two IPOs of new listed real estate investment businesses (Life Science REIT, which trades at approximately a 30% discount to its IPO price, and Home REIT, which is currently suspended after a short seller attack triggered a sequence of events including a strategic review and most recently the appointment of a new investment manager).

For as long as share prices are depressed, equity capital-raising remains challenging and credit markets are tight, we anticipate that takeover activity in this market will continue as more companies pursue scale through merger transactions or are the targets of cash-rich investors including private equity firms.

While it is disappointing to see the UK’s listed real estate sector shrinking, there are many sub-scale companies and there is little doubt that investors would be better served by larger companies with greater share liquidity, lower cost ratios (as a result of economies of scale) and greater access to debt capital markets.

BCLP Track Record

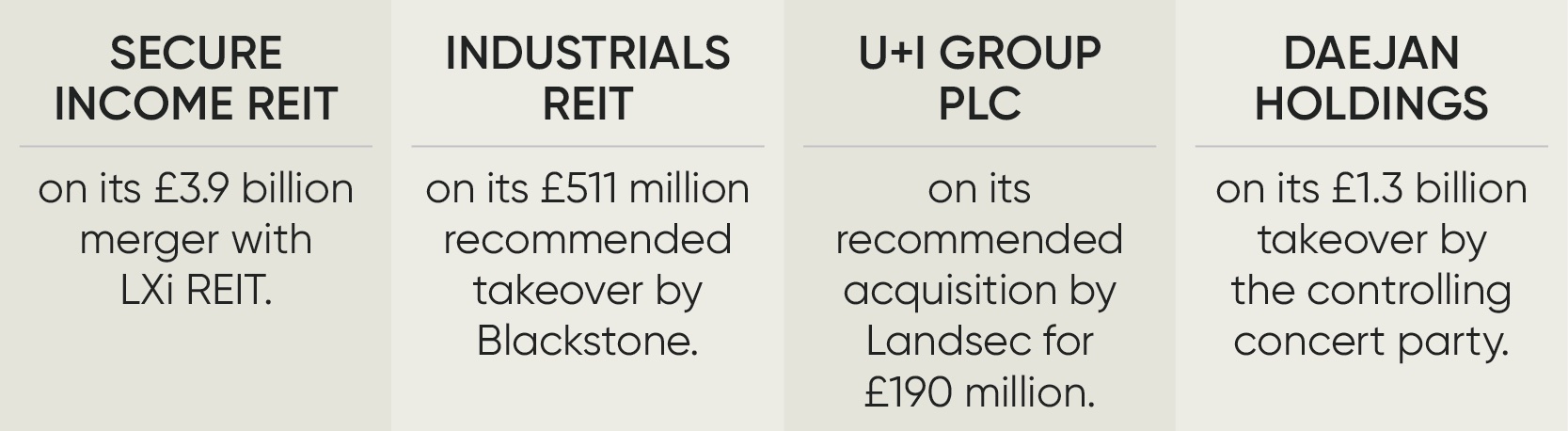

BCLP has the leading real estate practice among UK law firms and our corporate team has advised on numerous public takeovers in the UK real estate sector, including the following:

[1]For the purpose of this analysis we have included in the universe of relevant listed real estate companies all property investment businesses with a market capitalisation in excess of £10million and whether traded on the LSE’s Main Market or on AIM. Companies investing in specialist property assets such as medical facilities, care homes, student accommodation, self-storage and social housing are included. We have excluded housebuilders and service providers such as property agencies.

[2]There were 4 completed deals in 2019, 2 in 2020 6 in 2021, 3 in 2022 and 2 to date in 2023. Source: Thomson Reuters Practical Law What’s Market

Related Practice Areas

-

M&A & Corporate Finance

-

UK Public Company

-

Real Estate