BCLPSecCorpGov.com

Icahn settles with SEC for failures to disclose key details of margin loan stock pledges

Teaching moment for directors and officers

Aug 20, 2024WHAT HAPPENED

On August, 19, 2024, the SEC announced settled charges against Carl C. Icahn and his publicly traded company, Icahn Enterprises L.P. (IEP), for failing to disclose information relating to Icahn’s pledges of IEP securities – representing a majority of outstanding units -- as collateral to secure personal margin loans worth billions of dollars. IEP and Icahn agreed to cease and desist orders and civil penalties.

TAKEAWAYS

Since 2006, companies have been required to disclose pledges of shares by NEOs and directors in the stock ownership table. The SEC believes that such pledges by insiders “may be subject to material risk or contingencies that do not apply to other shares beneficially owned by these persons,” and as a result, such arrangements “have the potential to influence management’s performance and decisions.” Similarly, Schedule 13D has long required disclosure of pledge arrangements and the filing of relevant agreements as exhibits.

In light of this case, companies and their advisors should review their controls and procedures related to margin loans and stock pledges, including confirmation that D&O and 13D questionnaires elicit adequate information to determine if insiders are engaged in pledging company securities, and that persons responsible for compiling such information and preparing relevant disclosures receive appropriate training and education.

Further, many companies prohibit margin loans in their insider trading policies. A key reason is the risk of a forced sale in the event of margin calls, which can also create insider trading issues and unwelcome publicity. Some also believe margins loans may potentially misalign the interests of management with those of shareholders, or create the perception of speculation. Accordingly, if a company does not currently prohibit, or at least discourage, stock pledges, this may present an opportunity to revisit its insider trading policy.

DEEPER DIVE

Background

The SEC settlement followed a series of events in mid-2023:

- On May 2, 2023, short-seller Hindenburg Research published a sharply critical report on IEP: Icahn Enterprises: The Corporate Raider Throwing Stones From His Own Glass House. Among other accusations, it claimed IEP overvalued its assets and used a “Ponzi-like” structure – claiming that IEP relies on new investors to fund dividends. It also questioned Icahn’s margin borrowing.

- According to IEP’s Q1 2023 10-Q, on May 3, 2023, the SDNY U.S. Attorney’s Office contacted IEP “seeking production of information relating to . . . corporate governance, capitalization, securities offerings, dividends, valuation, marketing materials, due diligence and other materials.”

- According to IEPs Q2 2023 10-Q, on June 21, 2023, the SEC contacted the company seeking such materials.

- According to AP News, the company’s market cap fell by more than half in May 2023, after the Hindenburg report — from about $18 billion on May 1 to $7 billion — and IEP’s stock fell over 60%.

Source: Axios, How Icahn's margin loans hurt him (Aug. 19, 2024).

- In IEP’s Q2 2024 10-Q filed on August 9, 2024, the company reported the U.S. Attorney investigation as still pending, along with two related putative class actions complaints and an action seeking inspection of books and records.

Icahn’s margin loans

According to the Icahn order and IEP order, since at least 2018, Icahn, who is IEP’s founder, controlling shareholder and chairman of the board of IEP’s general partner, pledged approximately 51 to 82 percent of IEP’s outstanding securities as collateral to secure personal margin loans worth billions of dollars from various lenders. Under their terms, a margin call could be triggered in the event that the closing market price of IEP’s depositary units fell by certain amounts. Various entities owned by Icahn entered into agreements to guarantee the loan obligations, including to deliver pledged collateral.

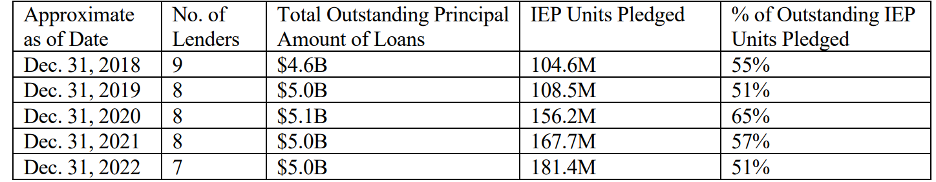

The following chart from the Icahn order summarized the margin loans:

On July 10, 2023, Icahn entered into an amended and consolidated margin loan agreement for a total outstanding principal amount of approximately $3.7 billion, which resulted in him pledging approximately 320 million IEP depositary units and $2 billion of his interests in private funds managed by a general partner affiliated with IEP (the “IEP Funds”). The IEP Funds were owned approximately 60% by IEP and 40% by Icahn and his wholly-owned entities. Various entities owned by Icahn also entered into agreements to guarantee the loan obligations.

Findings of 13D violations

The Icahn order notes that:

- Item 6 of Schedule 13D requires a description of any contracts or other arrangements between the person(s) filing the Schedule 13D and any person with respect to any securities of the issuer, including among other things, “for any of the securities that are pledged.”

- Item 7 of Schedule 13D requires the filing as exhibits of copies of written agreements relating to the guarantees of loans as disclosed in Item 6, among certain other types of agreements.

According to the Icahn order, Icahn’s 13D amendments filed in 1995, 2003 and 2005 generally disclosed that he and his affiliates pledged certain IEP depositary units as collateral for personal margin loans but failed to disclose the number of units pledged or the terms of any agreements. Additionally, the order indicates that beginning in 2005, Icahn entered into dozens of margin loan agreements or amendments with various lenders, including at least eleven from 2018 to 2022, which resulted in pledges of additional IEP depositary units or interests in IEP Funds as collateral. No amendments were filed describing those arrangements until July 10, 2023. On that date, a 13D amendment was filed that described the general terms of the amended loan agreement under Item 6, including the names of lenders, the principal payments owed, amounts of IEP depositary units and interests in IEP Funds pledged, and events of default. However, it did not attach the guarantee agreement, as required under Item 7. On July 5, 2024, Icahn filed a 13D amendment attaching that agreement.

According to the Icahn order, Icahn represented that he disclosed his various margin loan arrangements to his advisors; however, those disclosures did not excuse his violations because an individual retains legal responsibility for compliance with the filing requirements.

Findings of Form 10-K violations

Item 403(b) of Regulation S-K requires public companies to disclose in Part III of Form 10-K information about the security ownership of NEOs and directors, including the amount of pledged securities, which include depositary units.

IEP was required to disclose the amount of IEP depositary units that Icahn pledged as collateral for his indebtedness because Icahn was a director of the general partner of IEP and a named executive officer of IEP. According to the IEP order, the company and its outside advisors were aware that Icahn had pledged IEP depositary units as collateral. Nevertheless, its Forms 10-K for 2018 through 2020, which were incorporated by reference in at least eighteen other IEP public filings, did not disclose that he had pledged IEP depositary units as collateral for personal margin loans or the numbers of units pledged.

On February 25, 2022, IEP disclosed for the first time in a footnote to its beneficial ownership table in its Form 10-K for the year ended December 31, 2021 that Icahn had pledged 167,658,659 IEP depositary units as collateral to secure personal margin loans. Those pledges reflected approximately 57% of all IEP depositary units outstanding at that time.

Terms of settlement

Icahn and IEP agreed to cease-and-desist from violations of Section 13(d)(2) and Section 13(a) of the Exchange Act, respectively, and to pay civil monetary penalties of $500,000 and $1.5 million, respectively.

Related Capabilities

-

Securities & Corporate Governance