BCLPSecCorpGov.com

Guidance from the SEC for new Pay versus Performance tables

Feb 22, 2023What happened

The SEC staff recently issued 15 interpretations (see Sections 128D and 228D) relating to its new Pay versus Performance (PvP) rules.

Takeaways

The interpretations address a number of questions arising as calendar-year companies prepare or finalize their new PvP disclosures for their 2023 proxy statements required by new S-K Item 402(v), which we summarized in our August 29, 2022 post.

The guidance addresses (1) the calculation of compensation actually paid shown in the table and related footnote disclosures, (2) peer group total shareholder return (TSR), (3) net income and Company-Selected Measures and (4) several specific fact scenarios.

Deeper dive

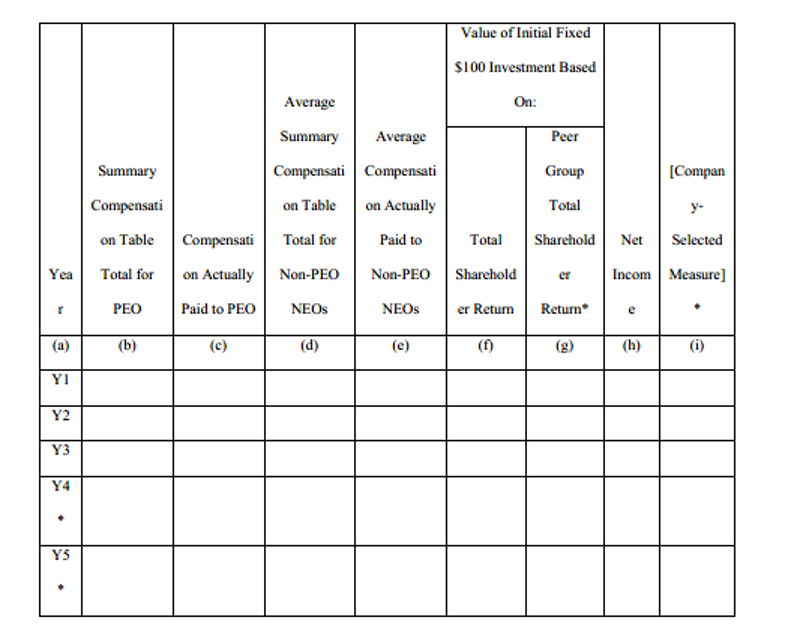

For reference, the new PvP disclosure requirements under S-K Item 402(v) require the following table in proxy statements containing executive compensation disclosure.

Pay Versus Performance

(Image from Adopting Release)

Guidance on adjustments to amounts in table and required footnotes

- Adjustments to previous equity awards. The compensation shown as actually paid in the PvP table should include adjustments to equity awards made before an employee became an NEO – even if the awards themselves are not reported in the Summary Compensation Table. [128D.02]

- Footnotes for prior fiscal years. In the first PvP table under the new rules, footnote disclosures for columns (c) and (e) should be provided for each year presented. In future years, they would be required only if “material to an investor’s understanding of the information reported in the Pay Versus Performance table for the most recent fiscal year, or of the relationship disclosure provided under Item 402(v)(5).” [128D.03]

- Itemize individual adjustments; don’t aggregate. When providing itemized adjustments in footnotes to columns (c) and (e) of the PvP table, companies should provide each individual adjustment made to pension values and equity awards – not aggregate amounts. [128D.04]

TSR peer groups and calculations

- CD&A peer groups allowed. For the TSR peer group calculation, companies may use any peer group used to help determine executive pay and disclosed in CD&A, even if not used for “benchmarking”. [128D.05]

- Effective date as starting point for TSR for recent IPOs. For a company that became public during the measurement period, the starting point for calculating TSR and peer group TSR for the PvP table should be the effective date of the Exchange Act registration statement. [128D.06]

- Peer group TSRs must use peer group disclosed in each CD&A. The peer group TSR for each year in the PvP table must be based on the peer group disclosed in CD&A for that year – even if that means using different peer groups for the TSR calculations in prior years. [128D.07]

Only GAAP net income allowed. Column (h) must include net income or loss as required by Regulation S-X in audited GAAP financial statements. Other amounts, such as net income attributable to controlling interest or registrant or income or loss from continuing operations are not permitted. [128D.08]

Company-selected measures; tabular list

- Company-selected measures derived from required measures. A Company-Selected Measure shown in column (i) can be any financial performance measure that differs from those required to be disclosed in the PvP table that meets the definition of a Company-Selected Measure. These can include those derived from, a component of, or similar to those required measures. They could also be included in the Tabular List required for the relationship disclosures under the new rules. [128D.09]

- Stock price as Company-Selected Measure. The company’s stock price may not be used if the company does not use it to link compensation actually paid to NEOs to company performance – such as where its only impact is through changes in the value of share-based awards. However, if stock price is a market condition for an incentive plan award, or used to determine the size of a bonus pool, it may be included as a Company-Selected Measure. [128D.10]

- Period limited to last fiscal year. The Company-Selected Measure must be the measure used for the most recently completed fiscal year – it may not be measured over a multi-year period. As a result, one-year relative TSR can be used as the Company-Selected Measure when used to determine executive compensation, but multi-year TSR cannot. [128D.11]

- Disclosures required even for “pool plan”. Where a bonus pool is paid out upon achievement of a financial performance measure, the Company-Selected Measure, the Tabular List and related relationship disclosures are required – even if individual payments to participants are made based on the compensation committee’s discretion. [128D.12]

Guidance for specific situations

- Aggregated disclosures for multiple CEOs. So long as not misleading, the compensation of multiple CEOs may be aggregated for purposes of the narrative, graphical or combined comparison between compensation actually paid and TSR, net income and the Company-Selected Measure. [128D.13]

- Changes in fiscal years -- use stub period without annualizing compensation. If a company changes its fiscal year during the covered time period it should provide the PvP disclosure for the "stub period" and not annualize or restate compensation. [228D.01]

- Following bankruptcy -- use same measurement period as stock performance graph. Where a new class of stock was used upon emergence from bankruptcy, the first PvP table should use the same measurement period as the stock performance graph, with footnote disclosure to explain the approach and its effect on the table. [228D.02]

PvP table not required in 10-K. The PvP disclosures are only required in proxy or information statements where Item 402 disclosures are required, such as for annual meetings. They will not be incorporated into other SEC filings unless the company specifically does so. [128D.01]

Related Practice Areas

-

Securities & Corporate Governance