Insights

Corporate Transparency Wave: New York and Beyond

What businesses need to know about the new or proposed state laws on Corporate Transparency

Aug 02, 2024Introduction

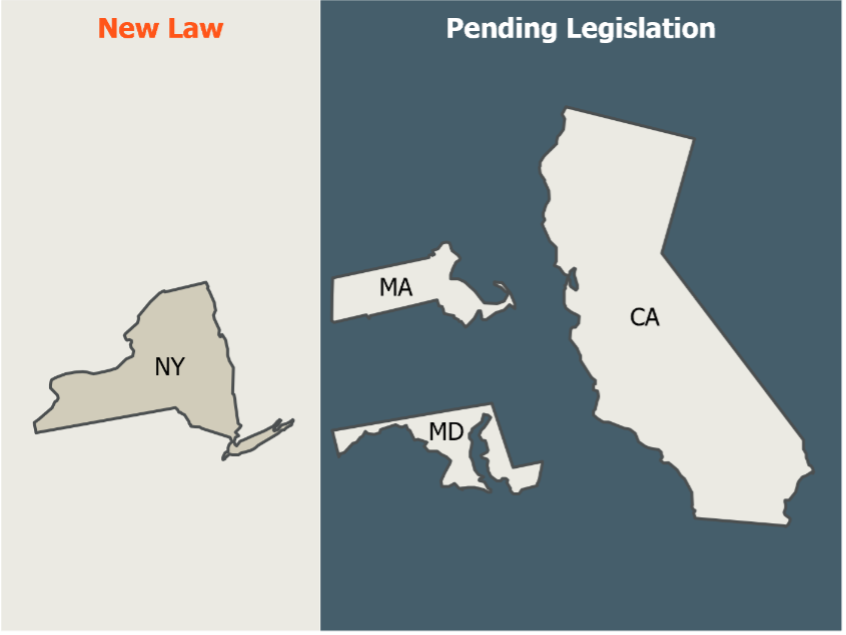

The federal Corporate Transparency Act (the “CTA”) has prompted certain states to consider their own laws aimed at increasing the transparency of beneficial ownership. This article delves into the recently enacted New York Limited Liability Company Transparency Act, alongside similar proposed legislation in California, Massachusetts, and Maryland. By examining these state-level initiatives, we uncover the similarities and differences with the CTA, and discuss the potential impact on corporate transparency nationwide.

New York Enacts the New York Limited Liability Company Transparency Act

Overview

On March 1, 2024, New York Governor Kathy Hochul signed into law amendments to the earlier enacted New York Limited Liability Company Transparency Act (the “NYLTA”).[1] The original bill was enacted on December 22, 2023, marking New York as the pioneering state to enact its own version of the CTA. The NYLTA, as amended, introduces new disclosure mandates for domestic and foreign limited liability companies (“LLCs”) operating within New York. Effective from January 1, 2026, the NYLTA will compel LLCs formed or registered to do business in the state to either disclose the identities of their beneficial owners to the New York Department of State (the “DOS”) or to attest (under penalty of perjury) to their exemption from reporting.

Effective Date and the Timing of Disclosure

Commencing on January 1, 2026, the NYLTA, as amended, mandates LLCs that are being formed in New York or foreign LLCs that are being registered to do business in New York to either file a beneficial ownership disclosure or an attestation of exemption with the DOS within thirty days of an initial filing of articles of organization or an application for authority.[2] LLCs formed or registered in New York before January 1, 2026 will have until January 1, 2027 to comply.[3]

The NYLTA and the CTA set up different requirements for updating the beneficial ownership information. While under the CTA an entity has 30 days to update any changes to information previously submitted to the government but no annual filing requirement, under the NYLTA all reporting companies and exempt companies must file an annual statement with the DOS confirming or updating: (1) beneficial ownership disclosure information; (2) the principal executive officer street address; (3) status as exempt company, if applicable; and (4) such other information as may be designated by the DOS.[4]

Scope of Application

The NYLTA has a specific focus on one entity type, differentiating significantly from the broader reach of the CTA. While the CTA encompasses a wide array of entities, including domestic or foreign corporations, LLCs, LPs or other entities created or, in case of foreign entities, registered in the United States,[5]the NYLTA narrows its purview to solely encompass domestic and foreign LLCs.[6]

This narrow approach is rooted in the NYLTA’s aim to address specific challenges associated with opaque LLC ownership structures that purportedly have, as Governor Hochul highlighted, facilitated a range of illicit activities, including wage theft, money laundering, and tenant mistreatment within New York.[7]The New York Committee noted in support of the NYLTA bill that forming an LLC in the United States is alarmingly simple, requiring less information than obtaining a library card.[8]

Attestation of Exemption

A significant deviation from the CTA is the NYLTA’s requirement that LLCs not classified as “reporting companies” must affirmatively submit, under penalty of perjury, an attestation of exemption.[9]In contrast, exempt entities under the CTA are not obliged to file any documentation to claim an exemption unless they have previously submitted a beneficial ownership disclosure to the federal government. The NYLTA specifies that an “exempt company” refers to an LLC or foreign LLC that qualifies for one of the exemptions outlined in 31 U.S.C. §5336(a)(11)(B) – mirroring the CTA’s 23 exemptions but applying them solely to LLCs.[10]Notable exemptions include: (i) a large operating company exemption; (ii) exemptions applied to entities registered under the Investment Company Act of 1940 or the Investment Adviser Act 1940; and (iii) exemption applied to companies whose ownership interests are controlled or wholly owned, directly or indirectly, by one or more entities that themselves qualify for certain exemptions (subsidiary exemption).[11]As previously discussed, such attestation of exemption statements must be filed with the DOS by January 1, 2027 for companies formed before the effective date of the NYLTA, and within thirty days of the submission of articles or organization or an application for authority for all companies formed on or after January 1, 2026.

Disclosure Requirements; Privacy Concerns Resolved

If an LLC formed or registered to do business in New York does not qualify for an exemption, then it must file a beneficial ownership disclosure with the DOS. While “beneficial owner” under the NYLTA has the same meaning as under the CTA,[12]the disclosure requirements under the NYLTA are slightly different. The beneficial ownership disclosure under the NYLTA requires each beneficial owner’s: (1) full legal name, (2) date of birth, (3) current home or business street address (as opposed to current residential address required under the CTA), and (4) a unique identifying number from (i) an unexpired passport; (ii) an unexpired state driver's license; or (iii) an unexpired identification card or document issued by a state or local government agency or tribal authority for the purpose of identification of that individual (as opposed to a unique identifying number and an image of an acceptable identification document required under the CTA).[13]The March 1, 2024 amendments to NYLTA also require the submission of information with respect to “company applicants”, a category adopted by the CTA relating to individuals who file an application to form or register an entity or individuals who direct or control such filing.[14]

In its original form, the NYLTA proposed creating a “publicly available database” of beneficial ownership information, a move that significantly diverged from the CTA and sparked privacy and security concerns. The database was to be accessible on the New York Secretary of State’s website and include, among other things, the full legal name of each beneficial owner for every reporting company, and potentially other details regarding beneficial owners, with limited options for individuals to seek a waiver based on significant privacy concerns. The NYLTA, as amended addressed privacy and security concerns, narrowing the database accessibility only to those in government who have a law enforcement interest in the information: “all information relating to beneficial owners. . . collected by the [DOS] . . . shall be maintained in a secure database and shall be deemed confidential except: (1) pursuant to the written request of or by voluntary written consent of the beneficial owner; (2) by court order; (3) to officers or employees of another federal, state or local government agency where disclosure is necessary for the agency to perform its official duties. . . ; or (4) for a valid law enforcement purpose including as relevant to any law enforcement investigation by the office of the attorney general . . .”[15]As Governor Hochul noted, such new approach will “allow individuals to be held accountable for misconduct, while preventing unnecessary intrusions into personal privacy.” [16]

Penalties

While penalties for noncompliance with the amended NYLTA are stricter compared to those under the original NYLTA, they still do not match the severity of penalties under the CTA, which provides for potential civil and criminal liability for persons who choose to disregard their beneficial ownership information reporting requirements.

If an LLC fails to file its beneficial ownership disclosure, attestation of exemption, or annual statement for more than 30 days, it will be marked as past due in the records of the DOS.[17] The New York State Attorney General has the authority to levy fines of up to $500 per day for each day the filing is overdue.[18] The past due status will be lifted upon submission of the NYLTA required disclosure or attestation, payment of a $250 fine, and confirmation from the New York State Attorney General that any previously imposed penalties have been settled.[19] Failure to file relevant disclosure, attestation of exemption, or annual statement for more than two years results in the LLC being listed as delinquent in the DOS records.[20]

Additionally, it is unlawful for any person to knowingly provide, or attempt to provide, false or fraudulent beneficial ownership information, including falsifying or identifying photographs or documents.[21] A person will not be in violation if the person voluntarily and promptly, and no later than within 90 days, provides the corrected information.[22] However, if such false or fraudulent information is submitted willfully to evade NYLTA requirements, the person remains in violation even if corrected within 90 days. [23]

The New York State Attorney General is empowered to seek dissolution or cancellation of any LLC delinquent in filing of its beneficial ownership disclosure or attestation of exemption, or that has violated NY Limit. Liab. Co. §1108(c).[24]The court may then make a judgment or final order dissolving the domestic LLC or revoking the authority of the foreign LLC.[25] Penalties specified in NYLTA are in addition to those required by the CTA and can be imposed alongside other remedies or penalties provided by other laws.[26]

Any LLC that fails to file its beneficial ownership disclosure or attestation of exemption, as applicable, shall be deemed suspended.[27]An LLC must receive at least thirty days’ notice prior to suspension taking effect.[28] During suspension, the LLC cannot conduct business in New York State until it files the required disclosure or attestation, at which point the suspension shall be lifted.[29]

California Senate Passes Senate Bill Number 1201 titled “Beneficial Owners”

Overview

In February 2024, California state senators introduced Senate Bill Number 1201 (“S.B. 1201”) titled “Beneficial Owners.”[30]The bill was amended on May 16, 2024, and passed in the California Senate on May21, 2024.[31]S.B. 1201 proposes amendments to the California Corporations Code (“Cal. Corp. Code”), mandating the disclosure of beneficial owners for corporations and LLCs conducting business in the state.[32]All changes proposed by S.B. 1201 would become operative on January 1, 2026.[33]

Corporations

Cal. Corp. Code §§1502 and 2117 already require every domestic corporation and foreign corporation qualified to transact intrastate business to file a statement with the California Secretary of State (“CSOS”) within 90 days after filing its original articles or designation of foreign corporation.[34]This statement must disclose certain information, including but not limited to the names and complete business or residence addresses of the corporation’s incumbent directors, chief executive officer, secretary, and chief financial officer. S.B. 1201 would expand this requirement to include the names and complete business or residence addresses of each beneficial owner.[35]A beneficial owner is defined as a natural person who directly or indirectly and through any contract arrangement, understanding, relationship or otherwise, either (1) exercises substantial control over the corporation, or (2) owns 25 percent or more of the equity interest of the corporation.[36]

Interestingly, while S.B. 1201 adopts the same definition of “substantial control” as set forth in §1010.380 of Title 31 of the Code of Federal Regulations (aligning the term with the CTA),[37] it remains silent on the interpretation of the “equity interest” prong of the definition.[38]This omission potentially narrows the scope of individuals that must be disclosed under California state law compared to the CTA. Indeed, under the CTA, the second prong of the “beneficial owner” definition encompasses any individual who, directly or indirectly “owns or controls at least 25 percent of the ownership interests” in the reporting company.[39]The definition of ownership interest under the CTA is extensive, covering:

|

||||||||||||

S.B. 1201’s lack of explicit reference to these detailed provisions of the CTA suggests that California legislators did not intend for the definition of individuals with equity interests to be as broad as under the CTA. By aligning only with the CTA’s definition of “substantial control” and omitting the comprehensive definition of “equity interest,” S.B. 1201 appears to potentially set a narrower scope for beneficial ownership disclosure. This could mean fewer individuals would be required to disclose their ownership under California law, potentially affecting the transparency and comprehensiveness of the beneficial ownership information collected.

Furthermore, unlike the CTA, S.B. 1201 does not impose strict timelines for updating beneficial ownership information. Under Cal. Corp. Code §§ 1502 and 2117, the corporations must file an annual statement and may file a new statement if any information changes before the annual filing.[41]Therefore, any changes in beneficial ownership must be reported at least annually, but corporations have the option to update their information sooner. Additionally, if no changes have occurred since the last filling, corporations can notify the CSOS of the same on a separate form.[42]

Another distinction from the CTA is that the beneficial ownership information reported under Cal. Corp. Code §§ 1502 and 2117 would be publicly available, as currently drafted.[43]These statements would be accessible to in an online database.[44] However, beneficial owners under S.B. 1201 can list their business address instead of residential address and are not required to disclose their date of birth or provide a government-issued identification document (items required for submission under the CTA),[45]thereby offering some protection to their private information.

Limited Liability Companies

Similarly, Cal. Corp. Code § 17702.09 already requires every domestic and foreign LLC to file a statement with the CSOS within 90 days after filing its original articles or registering to transact business in the state. The statement must disclose certain information, including but not limited to “[t]he name and complete business or residence addresses of any manager or managers and the chief executive officer, if any. . . or if no manager has been so elected or appointed, the name and business or residence address of each member.”[46] S.B. 1201 would require LLCs to also include the names and complete business or residence addresses of any beneficial owner on the statement (but not the individual’s date of birth or a government-issued identification document required under the CTA).[47] The definition of an LLC’s beneficial owner mirrors that for corporations as discussed above[48] and potentially covers a narrower scope of individuals compared to the CTA.

LLCs are required to file the statement of information biennially, as opposed to the annual requirement applicable to corporations in California.[49]Additionally, similar to the law for corporations, if there have been no changes in the information on the statement since the last filing, LLCs can notify the CSOS on a separate form that no changes have occurred.[50]

It is not clear under the current bill if the information filed pursuant to Cal. Corp. Code §17702.09 (and S.B. 1201, Section 3, purporting to amend §17702.09 as discussed above) will be made available to the public. While Cal. Corp. Code §17702.09 or Section 3 of S.B. 1201 (applicable to LLC) do not explicitly state that the information will be publicly available, the CSOS’s website provides that when a person submits documents for filing with the CSOS it is making a public record and all of the information and the documents the person provides for filing shall be available to the public for viewing and copying.[51] Thus, beneficial owners of domestic or foreign LLCs should keep those considerations in mind if S.B. 1201 is enacted.

No Exemptions

Another way S.B. 1201 differs from the CTA is the lack of exemptions from reporting for corporations and LLCs. Under S.B. 1201, all domestic and foreign corporations and LLCs qualified to conduct intrastate business must report their beneficial owners. This means that if S.B. 1201 is passed, certain entities exempt under the CTA will need to conduct a beneficial ownership analysis to comply with California state law.

Additional Fees

Sections 12176, 12186 and 12190 of California Government Code will be amended to allow the CSOS to increase the fees required for the filings by domestic and foreign corporations and LLCs qualified to transact business in the state. However, S.B. 1201 states that the increased fees will not exceed the reasonable cost of any regulatory activities necessary to implement the amendments.[52]

Penalties

While S.B. 1201 does not lay out any penalties for non-compliance, Cal. Corp. Code § 17702.07 imposes the liability for a statement of information that contains inaccurate information.[53]If a person suffers a loss by reliance on the information, that person may recover damages from the person that signed the record, or caused another to sign it on the person’s behalf, and knew the information to be inaccurate at the time the record was signed.[54] A member of a member-managed limited liability company or the manager of a manager-managed limited liability company will be liable if: (1) the record was delivered for filing on behalf of the limited liability company and (2) the member or manager had notice of the inaccuracy for a reasonably sufficient time before the information was relied upon so that, before the reliance, the member or manager reasonably could have either effected an amendment, filed a petition, or delivered for filing a statement of information under Cal. Corp. Code § 17701.14 or a certificate of correction.[55]

Maryland Senate Introduces Senate Bill Number 954, an Act Concerning Beneficial Ownership Transparency

Overview; Scope of Application

On February 2, 2024, Maryland Senator Charles E. Sydnor, III introduced Senate Bill 954 titled “Corporations and Associations – Transparency – Beneficial Ownership” (“S.B. 954”) pursuant to which certain businesses would be required to file a beneficial ownership report with the Maryland State Department of Assessments and Taxation (the “Maryland Department”). Contrastingly to the CTA, which has a broader reach with respect to the entities subject to its reporting requirements, S.B. 954 exclusively applies to entities “created” in the state of Maryland (a “Reporting Entity”).[56]

Beneficial Owners and Applicants

S.B. 954 proposes amendments to Sections 1-210 and 4-327 of the Annotated Code of Maryland (“Md. Code Ann.”) and seeks to require a Reporting Entity to file a report with the Maryland Department identifying such entity’s “beneficial owner(s)” and “applicant(s)”.

Under S.B. 954, a “beneficial owner” is defined as “[a]n individual who through any contract, arrangement, understanding, relationship, or other means: (1) exercises substantial control over a [R]eporting [E]ntity; or (2) owns or controls at least 25% of the ownership interest of a [R]eporting [E]ntity.”[57]The definition of “beneficial owner” under S.B. 954 is comparable to the definition of “beneficial owner” under the CTA; however, there are two main distinctions. First is the fact that, unlike the CTA, S.B. 954 fails to clarify what constitutes “substantial control”. Second is the fact that, unlike the CTA, S.B. 954 fails to identify what constitutes an “ownership interest”.

S.B. 954’s inability to specify what constitutes “substantial control” or an “ownership interest” prevents companies from eliminating individuals that do not satisfy the definition of “beneficial owner” when analyzing who should be reported. Instead, the broad language and lack of examples opens the door, intentionally or otherwise, for companies to over or under disclose their beneficial owners. Coupled with the narrow 30-day window in which to amend a report (as discussed below), the vague nature of the “beneficial owner” definition under S.B. 954 creates a large margin of error as to the accuracy of a company’s report.

An additional difference of note is the fact that S.B. 954 expressly contemplates the avenues by which an ownership interest in an entity might be created (i.e., by way of contract, understanding, etc.) while the CTA is silent in this regard.

Under S.B. 954, an “applicant” is defined as, “[a]n individual who files with the [Maryland Department] any document causing a [R]eporting [E]ntity to be formed”[58]. This definition differs slightly under S.B. 954 than under the CTA. To explain, the CTA provides that a “company applicant” is an individual who files the application to form an entity (e.g., a certificate of formation or articles of incorporation) whereas S.B. 954 seemingly casts a wider net by including any individual who files any document with the Maryland Department causing a reporting entity to be formed.[59]The broad phraseology of “any document” under S.B. 954 could result in more than one person being deemed an “applicant”. To explain, under S.B. 954, it is entirely plausible that different individuals could file the requisite formation documents with the Maryland Department and, as a result, all such individuals would satisfy the definition of “applicant” and would need to be identified on the entity’s report.

Effective Date and Timing

If ultimately enacted into law in its current form, S.B. 954 would take effect October 1, 2024.[60]Entities formed prior to October 1, 2024, must file their report by October 1, 2025.[61]S.B. 954’s one-year filing period is consistent with the one-year period granted to entities formed before January 1, 2024, under the CTA. Unlike the 90-day filing period afforded to entities formed after January 1, 2024, under the CTA, entities formed or qualified in Maryland after October 1, 2024, must file the ownership report within 30 days from the date the requisite documents are filed with the Maryland Department.[62]Similar to the CTA, S.B. 954 imposes strict guidelines if an entity’s beneficial ownership information should change. Upon the occurrence of any such change the reporting entity must file an amended report with the Maryland Department within 30 days.[63]

Information Required

Each reporting entity shall file a report that will contain the following information for each applicant and beneficial owner: (1) their full legal name, (2) a current residential or business address, and (3) an acceptable identification document.[64]An “acceptable identification document” means (a) a valid U.S. passport, (ii) a valid identification document issued by a state, local government, or Indian tribe, or (iii) a valid driver’s license issued by a state, or (iv) if the individual does not have any of the foregoing items, a valid passport issued by a foreign government.[65]

No Exemptions

A key distinction from the CTA is the fact that S.B. 954 is silent with respect to the existence or application of any exemptions that would preclude an entity from having to file. Accordingly, as presently contemplated, S.B. 954 obligates all entities formed or qualified in Maryland to report their beneficial ownership information, even if such entity would otherwise be exempt under the CTA.

Penalties

Under S.B. 954, a person may not knowingly fail to submit a report required by the proposed law and a person may not cause to be filed a report that the person knows contains false information.[66] The Department may impose a civil penalty for a violation of $500 for each day the violation continues.[67]

Massachusetts House Introduces House Bill Number 3566 “An Act to Ensure LLC Transparency”

Overview

On March 30, 2023, the Commonwealth of Massachusetts introduced a House Bill titled “An Act to Ensure LLC Transparency” (“H. 3566”) in the House of Representatives. H. 3566 aims to mandate the disclosure of beneficial ownership information for LLCs conducting business in the Commonwealth.[68]Unlike the CTA, which has a broader reach concerning the types of entities subject to compliance, H. 3566 specifically targets only domestic and foreign LLCs registered to do business in Massachusetts.[69]

The Timing of Disclosure and Duty to Update

H. 3566 proposes amendments to Massachusetts General Law (“Mass. Gen. L.”), Ch. 156C, §§ 12 and 48, requiring the disclosure of beneficial owners on the certificate of organization or application for registration of domestic and foreign LLCs registering to do business in the Commonwealth.[70] Consequently, the beneficial owners would need to be disclosed simultaneously with forming of a domestic LLC or registering a foreign LLC in the Commonwealth.

Currently, Massachusetts law requires LLCs to file annual reports updating any information required to be set forth in the certificate of organization or application for registration.[71] H. 3566 seeks to increase the frequency of these updates. Any change in the beneficial ownership or related information of a domestic LLC must be updated in an amended certificate of organization.[72]Unlike the CTA, Section 3 of H. 3566 does not set a specific number of days in which the certificate must be amended following the change. However, existing Massachusetts law implies that such updates shall be provided promptly following the change.[73]Similarly, if a change occurs in the beneficial ownership or related information of a foreign LLC registered to transact business in the Commonwealth, the application for registration must be amended.[74]For foreign LLCs, any change must be reported by amending the application for registration within 30 days of the change, similar to the timeline set forth in the CTA.[75]

Beneficial Owners Subject to Disclosure

H. 3566 introduces its own definition of a “beneficial owner”, significantly departing from the definition provided by the CTA. Under H. 3566, a “beneficial owner” is defined as a person who, directly or indirectly: (i) holds a membership interest in an LLC or a foreign LLC, (ii) exercises substantial control over the decisions of a member interest, or (iii) has been assigned a membership interest.[76]Unlike the CTA, which defines a beneficial owner as an individual holding 25 percent or more of the ownership interests in the entity,[77] H. 3566 does not specify a minimum percentage threshold. This omission potentially broadens the pool of individuals subject to disclosure under Massachusetts law. Furthermore, H. 3566 does not reference the CTA for the interpretation of “ownership interest” or “substantial control” (unlike other states’ enacted or proposed laws discussed above), thereby potentially creating a separate evaluation standard at the state level.

Similar to the CTA, H. 3566 excludes certain individuals from being considered beneficial owners, including: (i) minors, (ii) persons acting as nominees, intermediaries, custodians or agents on behalf of another person, (iii) employees whose control over or economic benefits from the LLC derives solely from the employment status, (iv) individuals whose interest is solely through a right of inheritance, and (v) creditors.[78]However, H. 3566 adds two additional exclusion categories: (i) any person whose membership interest derives solely from their employment, and (ii) any person whose membership interest derives solely from an LLC’s certificate of organization in sections 12 or 13 of Mass. Gen. L. Ch. 156C, or a foreign LLC’s application for registration in sections 48 or 52 of Mass. Gen. L. Ch. 156C.[79]

H. 3566 also includes a unique disclosure requirement not reflected in the CTA or other state laws discussed above. If (i) indirect beneficial ownership is exercised through a publicly traded entity, a REIT, a UPREIT, or a mutual fund; and (ii) the beneficial owner is holding or controlling 25 percent or more of the equity in such LLC,[80]the beneficial owner must identify each and every entity or person linking such beneficial owner to the LLC. This includes (i) identifying every intermediary by name and explaining the nature of the legal or economic relationship of the beneficial owner to each such intermediary, and (ii) detailing how each such intermediary is linked to every other intermediary and to the LLC.[81]The Massachusetts Secretary of State (“MSOS”) may also permit or require the beneficial owner to provide a diagram to meet the disclosure requirement.[82]If this portion of the bill is passed as written, LLCs and beneficial owners subject to this provision will have to submit a substantial amount of additional information not required under the CTA.

Information Required for Submission

The beneficial owner-related information required for submission under H. 3566 largely mirrors the requirements of the CTA, with a few exceptions. Similar to the CTA, H. 3566 requires LLCs to provide the following information for each beneficial owner: (i) name, (ii) date of birth, and (iii) a unique identifying number for a non-expired U.S. passport, driver’s license or state-issued ID , or foreign passport.[83] While the CTA mandates the disclosure of the beneficial owner’s residential address, H. 3566 allows for either a residential or business address.[84] H.3566 also requires a beneficial owner’s federal or state taxpayer identification number or a legal entity identifier issued by the global legal entity identifier foundation, whereas the CTA does not require entities to submit their beneficial owners’ tax identification numbers (requesting only those pertaining to the reporting entities themselves).[85]Additionally, unlike the CTA, H. 3566 requires LLCs to disclose the total number of properties, if any, owned by each beneficial owner in the Commonwealth, along with the city or town each property is located in the Commonwealth.[86]

Interestingly, H. 3566 permits LLCs to submit a copy of the beneficial ownership information provided to the federal government under the CTA to satisfy the Commonwealth’s disclosure requirements, provided that the federal registration is current and contains all required information.[87]However, it is unclear how this will work given that H. 3566 requires additional information not mandated under the CTA. This discrepancy is further complicated by the differences in the definition of beneficial owners between the CTA and H. 3566 discussed above.

Publicly Available Database and Privacy Concerns

In contrast to the CTA, H. 3566 mandates that all disclosed information filed with the MSOS pursuant to H. 3566 be a matter of public record.[88] The requirement for public disclosure could be problematic, as under H. 3566 beneficial owners must submit certain sensitive information such as their date of birth, tax identification numbers, unique identifying numbers from government-issued documents and information related to their properties located in the Commonwealth. Making this information publicly available raises significant privacy concerns. The potential exposure of such personal data may lead to identity theft, fraud, and other privacy infringements. Beneficial owners might be particularly vulnerable if their residential addresses are included, as this could pose safety risks. The CTA, by contrast, keeps beneficial ownership information confidential, with access limited to authorized government agencies for law enforcement and regulatory purposes (and submitting CTA filings to MSOS as suggested by H. 3566 could inadvertently expose sensitive personal information that was intended to remain confidential under federal law). This difference highlights a critical area of concern for those impacted by H. 3566, as the balance between transparency and privacy becomes a pivotal issue. If H. 3566 is enacted as written, LLCs and individuals subject to its requirements will need to consider these privacy implications carefully.

No Exemptions

Unlike the CTA, H. 3566 does not lay out any exemptions for entities. This means all LLCs created in Massachusetts or registered to do business in Massachusetts will be required to submit the beneficial ownership information, even if they are exempt under the CTA.

Conclusion

As states implement and propose their own transparency laws in response to the CTA, businesses must remain vigilant in understanding and complying with these emerging requirements. Key considerations include ensuring timely filing of disclosures and updates to avoid penalties and business interruptions, assessing the implications of public disclosure requirements to protect sensitive information, understanding specific definitions and thresholds for beneficial ownership in each state, and reviewing the availability of exemptions to determine compliance obligations.

For detailed guidance and assistance with navigating these new and proposed laws, please reach out to BCLP. Our team is here to help ensure your business remains compliant and informed. BCLP will continue to monitor the implications of the NYLTA and other similar proposed state laws. Note that the information regarding the proposed legislation is current as of July 29, 2024, but may be amended by the states before it is passed. Please note that BCLP does not provide advice as to the application of these laws to an entity unless we have been expressly engaged to provide such advice.

[1] Legislation S.995B/A.3484; see also Press Release, “Governor Hochul Signs the LLC Transparency Act, December 23, 2023” (available at: https://www.governor.ny.gov/news/governor-hochul-signs-llc-transparency-act) (last visited on February 5, 2024).

[2] See NY Limit. Liab. Co. §1107(d).

[3] See NY Limit. Liab. Co. §1107(e).

[4] See NY Limit. Liab. Co. §1107(g).

[5] See 31 U.S.C.A. § 5336(a)(11).

[6] See NY Limit. Liab. Co. §1106(b).

[7] See Press Release, “Governor Hochul Signs the LLC Transparency Act”, December 23, 2023.

[8] See 2023 New York Senate Bill No. 995, New York Committee Report, New York Two Hundred Forty-Sixth Legislative Session held on January 23, 2023.

[9] See NY Limit. Liab. Co. §1107(b)

[10] See NY Limit. Liab. Co. §1106(c).

[11] See 31 U.S.C. §5336(a)(11)(B).

[12] See NY Limit. Liab. Co. §1106 “’Beneficial owner’ shall have the same meaning as defined in 31 U.S.C. § 5336(a)(3), as amended, and any regulations promulgated thereunder.” For reference, under 31 U.S.C. §5336(a)(3), a “beneficial owner” means, “with respect to an entity, an individual who, directly or indirectly, through any contract, arrangement, understanding, relationship, or otherwise (i) exercises substantial control over the entity; or (ii) owns or controls not less than 25 percent of the ownership interest of the entity” (with exemptions applicable to certain categories of individuals, e.g. a minor child, a nominee, a creditor, etc.).

[13] See NY Limit. Liab. Co. §1107(a); see also 31 U.S.C. §5336(a)(2)(A); §1010.380(b)(1)(ii), title 31 the Code of Fed. Reg.; 87 Fed. Reg. 59,519.

[14] See NY Limit. Liab. Co. §1107(a). For reference, under NY Limit. Liab. Co. §1106(d) “’Applicant’ shall have the same meaning as defined in 31 U.S.C. §5336(a)(2), as amended, and any regulations promulgated thereunder, but shall only include those relating to limited liability companies.” See also 31 U.S.C. §5336(a)(2); 87 Fed. Reg. 59,536.

[15] NY Limit. Liab. Co. §1107(f).

[16] Governor Kathy Hochul, N.Y., Approval Memo. 91, Chap. 772, Filed with Senate Bill 995-B (December 22, 2023); see also Press Release, “Governor Hochul Signs the LLC Transparency Act”, December 23, 2023.

[17] See NY Limit. Liab. Co. §§1108(a)(1), (d).

[18] See NY Limit. Liab. Co. §1108(a)(2).

[19] See NY Limit. Liab. Co. §1108(a)(3).

[20] See NY Limit. Liab. Co. §1108(b)(1).

[21] See NY Limit. Liab. Co. §1108(c).

[22] Id.

[23] Id.

[24] NY Limit. Liab. Co. §1108(e)(1). For reference, NY Limit. Liab. Co. §1108(c) provides that “[i]t shall be unlawful for any person to knowingly provide, or attempt to provide, false or fraudulent beneficial ownership information, including a false or fraudulent identifying photograph or document, to the [DOS] . . .”

[25] See NY Limit. Liab. Co. §1108(e)(1).

[26] See NY Limit. Liab. Co. §1108(f)

[27] NY Limit. Liab. Co. §1108(g)

[28] Id.

[29] Id.

[30] See 2023 California Senate Bill No. 1201.

[31] See S.B. 1201, as amended on May 16, 2024.

[32] Id, Sections 1, 2 and 3.

[33] Id.

[34] See Cal. Corp. Code §§1502(a), 2117(a).

[35] See S.B. 1201, Sections 1 and 2.

[36] Id.

[37] Id.

[38] Id.

[39] See §1010.380(d), Title 31 of the Code of Fed. Reg.

[40] Id, §1010.380(d)(i).

[41] Cal. Corp. Code §§1502(a), 2117(a).

[42] See Cal. Corp. Code §§1502(c), §2117(f).

[43] See Cal. Corp. Code §§1502(h), 2117(c).

[44] Id.

[45] See S.B. 1201, Sections 1, 2 and 3.

[46] See Cal. Corp. Code §17702.09(a)(5).

[47] See S.B. 1201, Section 3.

[48] Id.

[49] See Cal. Corp. Code §17702.09(a); Compare to Cal. Corp. Code §§1502(a) and §2117(a).

[50] See Cal. Corp. Code §17702.09 (b).

[51] See California Secretary of State Website, FAQs – Persona Information in Public Filings, (available at: https://www.sos.ca.gov/business-programs/pi-faqs) (last visited on July 31, 2024).

[52] See S.B. 1201, Sections 4, 5, and 6.

[53] See Cal. Corp. Code §17702.07.

[54] Id, §17702.07(a)(1).

[55] Id, §17702.07(a)(2).

[56] 2024 Maryland Senate Bill No. 954, Section 1. A “Reporting Entity” means an entity created by the fling of any document with the Maryland Department.

[57] See 31 U.S.C §5336(a)(3); See S.B. 954, Section 1.

[58] See 31 U.S.C §5336(b)(2); See S.B. 954, Section 1.

[59] See 31 U.S.C §5336(a)(2).

[60] See S.B. 954, Section 3.

[61] Id, Section 2.

[62] Id.

[63] See 31 U.S.C §5336; See also S.B. 954, Section 1.

[64] See S.B. 954, Section 1.

[65] Id.

[66] Id.

[67] Id.

[68] See 2023 Massachusetts House Bill No. 3566.

[69] See 31 U.S.C §5336(a)(11); See H. 3566, Sections 2 and 4.

[70] Id, Sections 2, 4.

[71] See Mass. Gen. L. Ch. 156C, §§ 12(c) and 48.

[72] See H. 3566, Section 3.

[73] See Mass. Gen. Laws Ann. Ch. 156C, § 13(b) (“A manager or, it there is no manager, then any member, who becomes aware that any statement in a certificate of organization was false when made, or that any matter described in the certificate of organization has changed, making the certificate of organization false in any material respect, shall promptly amend the certificate of organization to correct such matter”) (emphasis added).

[74] See H. 3566, Section 5.

[75] See 31 U.S.C §5336(b)(1)(D); See H. 3566, Section 5.

[76] H. 3566, Section 1.

[77] See 31 U.S.C §5336(a)(3).

[78] See 31 U.S.C §5336(a)(3)(B); H. 3566, Section 1.

[79] See H. 3566, Section 1.

[80] Id, Section 6.

[81] Id.

[82] Id.

[83] See §1010.380(b)(1)(ii), Title 31 the Code of Fed. Reg.; See H. 3566, Section 6.

[84] Id.

[85] Id.

[86] See H. 3566, Section 6.

[87] Id, Section 6.

[88] Id

Related Practice Areas

-

Corporate