Insights

Corporate Briefing - May 2023

May 02, 2023Summary

Welcome to the Corporate Briefing, where we review the latest developments in corporate law that you need to know about. In this month’s issue, we discuss:

HM Treasury (HMT) and FCA review of the criminal market abuse regime

- Following a review of the criminal regime, the FCA and HMT have identified a number of areas where the government believes it would be appropriate to update the regime.

- The Panel has published Response Statement RS2022/3 and 2022/4 introducing various amendments to the Takeover Code which take effect on 22 May 2023.

New proposals in the Green Finance Strategy for the UK’s largest private companies

- In March 2023 the government announced plans to consult, in Autumn/Winter 2023, on a requirement for the UK's largest companies to disclose net zero transition plans.

FCA Speech on reforming our capital markets ecosystem

- A recent speech by the FCA’s Chief Executive confirms the FCA revised proposals for the reform of the listing regime.

PLSA Stewardship and Voting Guidelines 2023

- The Pensions and Lifetime Savings Association (PLSA) has released its 2023 Stewardship and Voting Guidelines.

New corporate offence of failure to prevent fraud

- The government is introducing a new offence for failure to prevent fraud to improve fraud prevention and hold organisations to account if they profit from fraudulent actions of their employees.

New requirements for reporting discrepancies about beneficial owners

- The Money Laundering and Terrorist Financing (Amendment) (No. 2) Regulations 2022 came into force on 1 April 2023.

ICGN statement on virtual AGMs post COVID

- The International Corporate Governance Network has released a statement calling on regulators to discourage companies from holding virtual only AGMs at the expense of “watered-down shareholder rights”.

Conversation starters between investors and audit committees

- The FRC has developed a series of questions aimed at promoting better engagement between investors and audit committees.

Court cancels share conversion under a provision that was ‘unambiguous’, but ‘absurd'

- A provision in the articles – read in isolation - allowed ordinary shareholders to convert the preference shares held by two investors into ordinary shares. The judge said that was absurd and couldn’t be right.

Court considers meaning of “material adverse change”

- A recent case looks at what counts as “material” when determining whether there has been a “material adverse change”.

HM Treasury (HMT) and FCA review of the criminal market abuse regime

Following a review of the criminal regime, the FCA and HMT have identified a number of areas where the government believes it would be appropriate to update the regime. No further details have been provided at this stage save that a draft statutory instrument has been published amending the Criminal Justice Act 1993 to bring the securities and markets broadly in line with those under the Market Abuse Regulation (MAR). The government also intends to repeal MAR and replace it with UK-specific legislation as part of its revocation of EU law.

Takeover Code changes

The Panel has published Response Statement RS2022/3 and 2022/4 introducing various amendments to the Takeover Code including:

- certain amendments to clarify how the offer timetable applies in a competitive situation; and

- various miscellaneous amendments including:

- providing the Panel with greater flexibility to grant a derogation or waiver from the Code in exceptional circumstances, for example, to facilitate a rescue of a company in serious financial difficulty;

- altering the deadline for publishing irrevocable commitments or letters of intent on a website; and

- introducing a new Rule requiring the target board circular to include a recommendation from the target board as to what action shareholders should take in respect of an offer (including any alternative offer). The Panel Executive has prepared four examples of language which a target board could use in the following situations: (a) a single, recommended offer; (b) a main offer and an alternative offer, both of which are recommendable; (c) a main offer which is recommended and an alternative offer which is not recommendable; and (d) a main offer which is recommended and an alternative offer on which the target board and the Rule 3 adviser are unable to form an opinion.

The changes will take effect on 22 May 2023 and apply to all companies and transactions as at this date including those which straddle this date.

New proposals in the Green Finance Strategy for the UK’s largest private companies

In March 2023 the Department for Energy Security and Net Zero, HM Treasury and Defra published an update (Mobilising Green Investment – 2023 Green Finance Strategy) to the government's 2019 Green Finance Strategy. Proposals include:

- plans to consult, in Autumn/Winter 2023, on a requirement for the UK's largest companies to disclose net zero transition plans, if they have them, to ensure parity between listed and private companies. These requirements could align closely with the existing FCA requirements for listed companies including the 'comply or explain' basis. It is anticipated that any such proposals will only apply to the UK’s most economically significant entities;

- launching a call for evidence on Scope 3 greenhouse gas emissions reporting;

- delivering a UK Green taxonomy - a tool to provide investors with definitions of which economic activities should be labelled as green; and

- consulting on regulating ESG ratings providers to seek views on how regulation could help ensure better outcomes for these products.

FCA Speech on reforming our capital markets ecosystem

A recent speech by the FCA’s Chief Executive confirms the FCA revised proposals for the reform of the listing regime:

- a single listing category (as proposed in the discussion paper last year) with one set of requirements;

- removal of the eligibility rules requiring a three-year financial track record as a condition for listing;

- a more permissive approach to dual class share structures;

- removal of the shareholder vote for large transactions and for related party transactions but maintaining a disclosure regime; and

- retention of a streamlined sponsor regime; a single set of Listing Principles and rules to protect shareholders from the solvent cancellation of a listing without a takeover offer or approval by a super majority of shareholders.

It is unclear precisely how the FCA has changed its proposals from those in the previous discussion paper but it would seem that they may be dropping the concept of a mandatory regime with issuers having a choice to adopt further additional obligations (see our original insight). If this is the case, these changes will be welcomed by the market which was generally opposed to the original proposals which didn’t seem to change the status quo of having two standards for listing, with one being seen as an “inferior” brand.

PLSA Stewardship and Voting Guidelines 2023

The Pensions and Lifetime Savings Association (PLSA) has released its 2023 Stewardship and Voting Guidelines. The main recommendations include the following:

- AGM Format: virtual AGMs should only be used in exceptional circumstances with in person attendance preferred.

- Remuneration: companies should show restraint in executive pay during the current cost of living crisis.

- Diversity: the guidelines stress the importance of meeting ethnic and gender diversity targets including the new requirements under the Listing Rules and the recently added 2027 goals set out in the Parker Review (see our earlier insight).

- Climate change: companies should expect heightened scrutiny from investors on climate related issues.

- Workforce: a new section has been included focussing on wellbeing including mental health, human rights and modern slavery and workforce gender and ethnic diversity.

- Cyber risks: given increased cyber risks associated with remote work, companies should have governance oversight structures in place to manage these threats and report on potential breaches and solutions.

New corporate offence of failure to prevent fraud

The government is introducing a new offence for failure to prevent fraud to improve fraud prevention and hold organisations to account if they profit from fraudulent actions of their employees.

Under the new offence an organisation will be liable if an employee commits fraud for the organisation’s benefit and the organisation did not have reasonable procedures in place to prevent the fraud. The offence will apply to large companies and partnerships, including non-profit organisations that meet at least two out of three of the following criteria: more than 250 employees; an annual turnover exceeding £36 million; and a total balance sheet of more than £18 million.

The offence would include fraud by false representation, false statements by company directors, false accounting, fraudulent trading and fraud by failing to disclose information and an organisation can receive an unlimited fine.

Once the Economic Crime and Corporate Transparency Bill receives Royal Assent, the government will need to publish guidance on reasonable prevention measures before the new offence can be enforced.

New requirements for reporting discrepancies about beneficial owners

Since January 2020, entities that run client due diligence under the Money Laundering Regulations have been required to report on any material discrepancies they discover relating to the details of beneficial owners. Those requirements were amended on 1 April 2023 by the Money Laundering and Terrorist Financing (Amendment) (No. 2) Regulations 2022 and Companies House has updated its guidance to note that: the requirements apply to discrepancies discovered at any time during the engagement, not just at client take-on, and to discrepancies relating to the details of registerable beneficial owners of overseas entities, not just persons with significant control under the PSC regime. The guidance also covers the sort of discrepancies that should be reported – that is, material discrepancies (e.g. where the registered person may be understood to be another person or where there is an incorrect entry regarding the nature of its control) and not just typos.

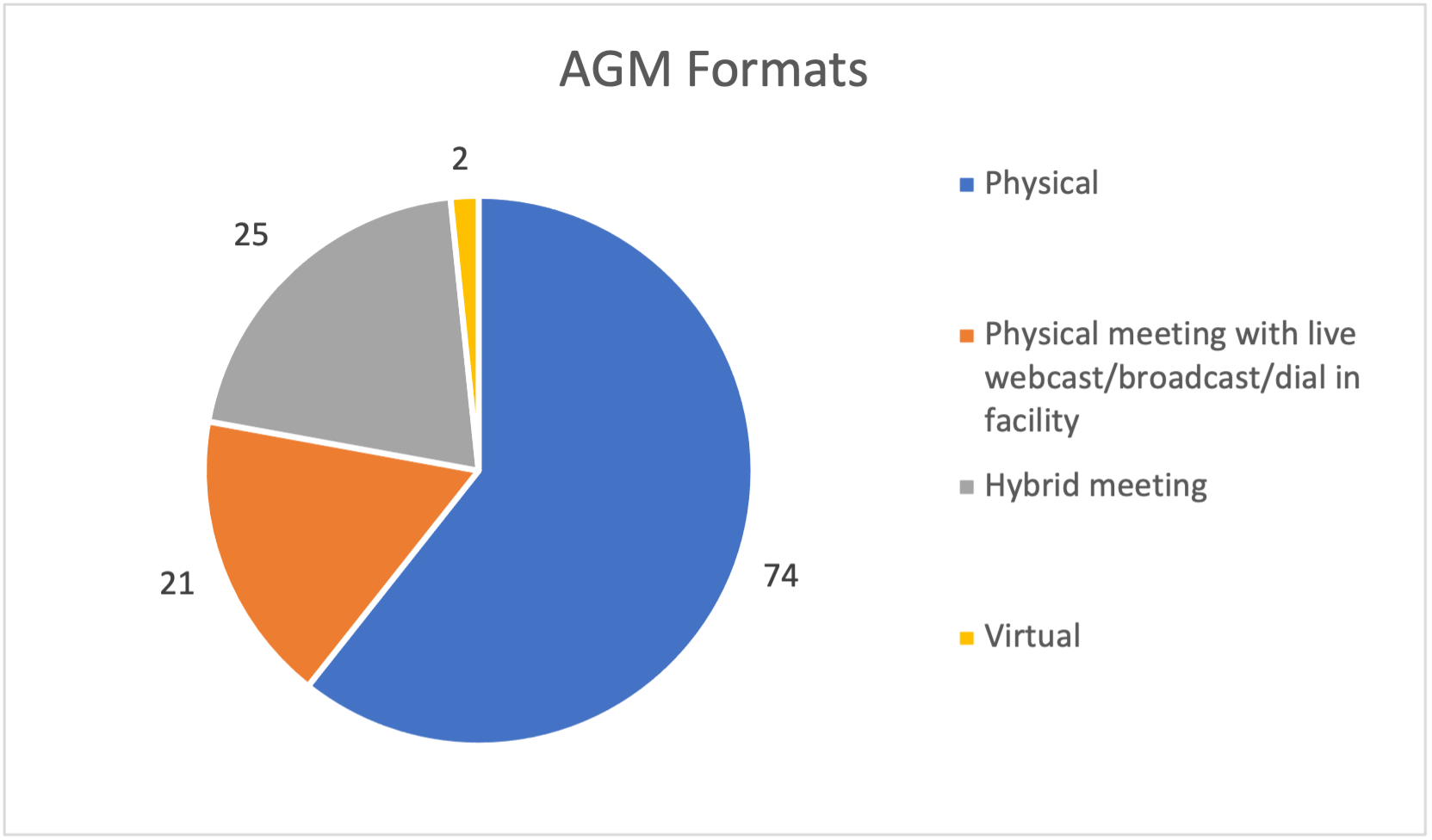

ICGN statement on virtual AGMs post COVID

The International Corporate Governance Network (ICGN) has released a statement calling on regulators to discourage companies from holding virtual only AGMs at the expense of “watered-down shareholder rights”. Whilst the ICGN recognise that virtual only AGMs were a practical solution during the pandemic, they significantly limit the ability for shareholders to interact with boards/management and should only be used in extreme situations. Going forward companies should consider hybrid AGMs enabling in-person and virtual participation.

An analysis of 122 published FTSE 350 AGMs notices for 2023* show that, as at 20 April 2023, the majority of companies intend to hold a physical meeting.

(collated from Thomson Reuters Practical Law What’s Market as at 20 April 2023).

Conversation starters between investors and audit committees

The FRC has developed a series of questions aimed at promoting better engagement between investors and audit committees. They provide a starting point for initial discussions and include the topics and questions set out below. Future areas of focus may include, further ESG-related considerations, approach to materiality, contextualising risk and business model, use of emerging technology and other topical issues as they emerge.

- Significant matters: please give more details about the significant issues the committee considered in relation to the financial statements; how have the significant issues been addressed?

- Risks – climate: please describe the committee’s role in relation to the reporting of climate-related risks; where relevant, is the committee satisfied with the level of assurance in the company’s TCFD disclosures?

- Risks – fraud: how does the committee satisfy itself that management has systems in place to detect fraud?

- Internal controls: please explain the committee’s role with regards to monitoring the effectiveness of internal audit; has there been any significant issues raised by internal audit and, if so, how has the committee addressed them?

It is hoped that these type of conversations will lead to greater transparency and investor confidence.

Court cancels share conversion under a provision that was ‘unambiguous’, but ‘absurd’

Ventura Capital GP Ltd v DnaNudge Ltd [2023] EWHC 437 (Ch)

When interpreting a provision, the court must give the words used their natural meaning unless that produces a ‘commercial absurdity’; and it may only imply a term if it is so obvious it goes without saying or is required to give business efficacy.

The provision in this case was a right to convert Series A Shares into Ordinary Shares contained in the Company’s articles under the heading ‘Conversion of Series A Shares’. It provided that the shares “shall automatically convert into Ordinary Shares upon notice in writing from an Investor Majority at the date of such notice.…”. The judge accepted that, in isolation, the provision was clear and unambiguous. However, because ‘Investor Majority’ was defined as “the holders of a majority of the Series A Shares and Ordinary Shares in aggregate as if such Shares constituted one class of share” it would allow the holders of the Ordinary Shares to convert the Series A Shares at any time because there were more Ordinary Shares than Series A Shares in issue. The judge considered that was absurd: no reasonable person would regard the articles as allowing that given the price paid by investors for the Series A Shares (£44m) and the special rights that the shares carried (principally, a preferential return). He determined that the conversion mechanism must be read as being subject to another article, headed ‘Variation of Rights’ (and he implied a term to that effect). That article provided that “the special rights attached to any class may only be varied or abrogated with the consent in writing of the holders of more than 75 % in nominal value of the issued shares of that class”. On that basis, any conversion notice would only take effect if the conversion was approved by 75% of the holders of the Series A Shares; and so, because they hadn’t approved it, the conversion was void.

The judge rejected the various arguments raised by the Company; e.g. that the investors – who had provided the definition of Investor Majority – had done a bad deal; that the Series A Shares hadn’t been varied at all (their rights remained the same as stated in the articles); and that the Series A Shares had instead been exchanged for Ordinary Shares (which was consistent, it argued, with the detailed provisions relating to the conversion which provided for new share certificates to be issued and for the register of members to be updated to record that the investors were now holders of Ordinary Shares).

The judge’s decision has caused some consternation/concern and an appeal is underway. But the decision highlights the need to make the inter-relationship between provisions that could overlap very clear – and, going forward, parties will want to specify whether or not any conversion mechanism is also subject to class consent (under a provision in the articles or, if there isn’t one, under the variation of rights provisions in the Companies Act 2006).

Court considers meaning of “material adverse change”

Decision Inc Holdings Proprietary Ltd v Garbett [2023] EWHC 588 (Ch)

This case looks at what counts as “material” when determining whether there has been a “material adverse change”. The judge noted that “material” is an ordinary English word and what it means depends on the context – which in this case was the sale and purchase of an IT consultancy company. The Sellers had warranted that “since the Accounts Date … there has been no material adverse change in the turnover, financial position or prospects of the Company”. The judge set out a straightforward approach to assessing whether the warranty had been breached: (1) determine the baseline position (i.e. what was the expected/forecast level of turnover etc as at the time of contract); (2) determine the actual position at the date of the contract; and (3) determine whether the difference between them is so great as to be material. The correct test for whether a change was material was whether it would cause a reasonable person - with the aims and objectives of the buyer - to withdraw from the transaction or renegotiate its terms.

The judge found that the warranty had been breached as the forecast EBITDA for the last two months before Completion had been c250K per month, whereas the actual EBDITA was minus 40K and plus 2K, respectively - with no secure pipeline of new business to make up for this. The Buyer had negotiated the price based on an EBITDA for the year of no less than 900K and it was in inconceivable that it would proceed on the agreed terms had it known that the actual position was expected to be 300K.

This case is of particular interest as there aren’t many English courts’ decisions dealing with material adverse change in the context of M&A. The judge chose to borrow from decisions of the US courts – and rejected the idea that materiality should be determined in accordance with accounting principles along the lines of a change of say 5% or more. In practice, for the sake of certainty, parties will generally want to define materiality in their agreements; however, a buyer will always prefer to do so on a ‘non-exhaustive’ basis – and, if it does that, this decision may be helpful to fall back on.

For further information please contact Benjamin Lee, Simon Beddow or your usual BCLP contact.

Related Practice Areas

-

Corporate