Insights

Indonesia in Focus - April 2020

Apr 29, 2020COVID-19 and Indonesia: 28 days later...

The Indonesian government has introduced numerous measures in response to the unfolding public health emergency. Large-scale social restrictions (“PSBB”) have been imposed in Jakarta and its satellite regencies, as well as other cities such as Tegal, Makassar and Pekanbaru.

To help mitigate the economic implications of the Covid-19 crisis, the Ministry of Finance has announced that it will set aside Rp 405.1 trillion (US$26.1 billion) for various emergency stimulus. President Joko Widowo signed Government Regulation in Lieu of Laws No. 1 of 2020 (the “Perppu”) to authorise the government to increase the budget deficit beyond the 3% of GDP ceiling (at the latest until the budget year of 2022) and expand public debt in order to pay for the stimulus.

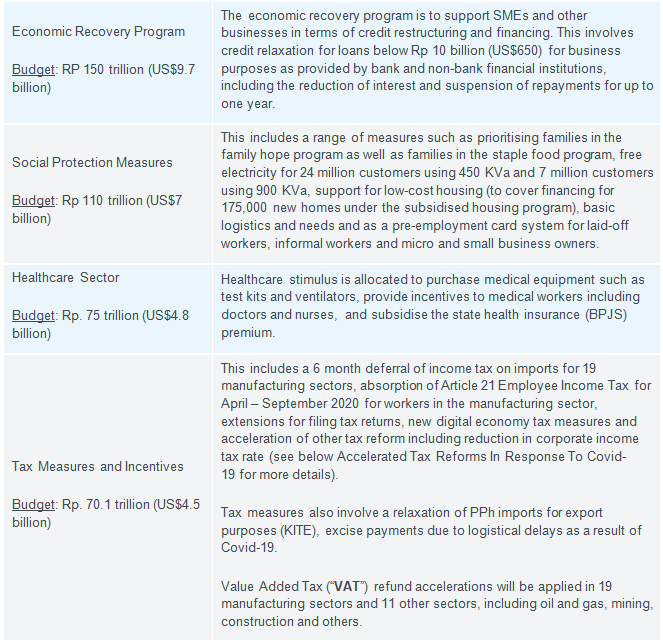

Emergency Stimulus Unveiled

The government has announced the stimulus packages to both absorb the shocks from the PSBB, as well as help the economy to recover once the crisis has been overcome, and workplaces start to re-open. The main packages are summarised in the following table.

Analysis

While the magnitude of the government’s policy response is significant, major uncertainties relating to the eventual duration and severity of the coronavirus outbreak pose risks to the effectiveness of the policy against the economic fallout. Also, at around 2.5% of GDP, Indonesia’s allocated spending for Covid-19 stimulus is relatively small compared to neighbours such as Thailand which have unveiled packages in excess of 10% of GDP.

It is indicative of the political sensitivities that the fiscal measures have attracted criticism from a number of national figures. The Perppu is the main regulatory authority for the government to expand the budget deficit beyond the 3% of GDP ceiling and enlist the support of Bank Indonesia for Indonesia’s “Pandemic Bonds”, which raised US$4.3 billion under a 50-year dated United States dollar bond. Whilst decision making amongst government officials is often hampered due to the perceived risk of being accused of causing a state loss, a potentially criminal offence, the Perppu states that government officials cannot be prosecuted on a criminal or civil basis, provided that they implement the Perppu in good faith and without breaching the Perppu.

Unhappy with the purported scope of the Perppu, a group of claimants have taken steps to test its constitutionality by way of judicial review. Under Indonesia’s Constitution, the President is given emergency powers to establish a government regulation in lieu of laws (known in the Indonesian language as peraturan pemerintah pengganti undang-undang or its abbreviation, ‘perppu’) in situations where swift and decisive action must be taken to guarantee security. However, it is open to interpretation as to the types of emergency situation which may justify a perppu.

Details of the constitutional claims will emerge as the case progresses in the Constitutional Court. Under the Constitution, the Perppu must also be approved by the House of Representatives at the next session, which has not yet occurred as of 20 April 2020, failing which it will be automatically revoked.

In the meantime, ministers and local government officials have been instructed to set aside non-priority expenditure plans in state or regional budgets, and re-focus budget and activities to address health and economic issues relating to Covid-19.

Accelerated tax reforms in response to COVID-19

On 31 March 2020 President Joko Widodo issued Government Regulation in Lieu of Laws No. 1 Year 2020 regarding State Financial and the Stability of the Financial System Policies for The Mitigation of Coronavirus Diseas 2019 (Covid-19) Pandemic and/or To Deal With Threats That Are Potentially Harmful To the Nationanl Economy and/or The Stability of The Financial System (the “Perppu”).

The Perppu establishes state revenue policies, including policies for the taxation sector, state spending policies, including policies for the central and regional financing sector. The financial system stability policies encompass policies for mitigating financial institution issues that are potentially harmful to the national economy or the stability of the financial system, in each case aiming to manage and relieve the economic impact of COVID-19. The Perppu’s taxation provisions broadly mirror those proposed in the Omnibus Tax Bill presented to the House of Representatives on 12 February 2020 as part of a wider initiative to boost foreign investment and drive the country’s manufacturing base. The Perppu accelerates the implementation of the Government’s tax reforms.

Corporate Income Tax

The Corporate Income Tax (“CIT”) rate for corporate taxpayers and permanent establishments for fiscal years 2020 and 2021 will be reduced to 22% from the current rate of 25%, and further reduced to 20% from fiscal year 2022. For Limited Liability Companies whose total number of shares traded on the Indonesia Stock Exchange is at least 40% of their paid-up capital that fulfil certain government requirements (which have yet to be defined), the CIT rate will be further reduced to 19% for fiscal years 2020 and 2021, and 17% from fiscal year 2022.

Tax on E-Commerce

The existing Value Added Tax (“VAT”) regime will apply to the utilisation of intangible taxable goods and taxable services delivered through an e-commerce system from an offshore area to Indonesia’s Customs Area. The providers of such goods and services will be required to collect, pay and declare VAT accordingly.

E-commerce activities delivered by foreign tax subjects (i.e. individuals and/or companies) with a ‘significant economic presence’ in Indonesia will be deemed as having a Permanent Establishment in Indonesia and subject to domestic income tax. The ‘significant economic presence’ will be determined by reference to the Ministry of Finance’s threshold of the following:

(i) the gross circulation of the consolidated business groups up to a certain amount;

(ii) sales in Indonesia up to a certain amount; and/or

(iii) active users of digital media in Indonesia up to a certain amount.

Foreign e-commerce providers that are not a Permanent Establishment in Indonesia will be subject to an Electronic Transaction Tax (“ETT”) on direct sales or sales through an electronic marketplace. The rate and procedure for payment of the ETT will be detailed in a subsequent regulation.

Foreign e-commerce providers that fail to comply with these tax regulations will be subject to a penalty under the existing General Tax Provision Law as regulated under Law No. 6 of 1983 as have been severally amended and lastly amended with Law No. 16 of 2009 and prohibited from trading in the Indonesian market.

Custom Duty

The Minister of Finance will have authority to grant customs facilities in the form of import duty facility or exemption under the existing Customs Law in connection with the mitigation of COVID-19 and threats to the national economy and system stability.

Details of the potential judicial review of the Perppu, including whether the tax provisions are likely to be affected, are likely to emerge as the case progresses in the Constitutional Court.

Fit-and-proper testing for prospective major parties of investment managers and investment advisors

Circular 2/2020

The Financial Services Authority (known in Indonesian as Otoritas Jasa Keuangan – “OJK”) has issued Circular No. 2/SEOJK.04/2020 on Fit-and-Proper Testing for Prospective Major Parties of Investment Managers and Investment Advisors (“Circular 2/2020”) which came into force on 19 February 2020. This Circular 2/2020 supplements OJK Regulation No. 27/POJK.03/2016 on Fit-and-Proper Testing for Major Parties of Financial Service Institutions, with a view to provide a rapid and transparent system of licensing.

Under Circular 2/2020, 3 types of candidates are subject to fit-and-proper testing, which are 1) candidates for controlling shareholders; 2) candidates for membership of boards of directors and 3) candidates for membership of boards of commissioners respectively. The relevant assessment factors include integrity, financial reputation and competence of the candidates. For candidates for controlling shareholders, financial feasibility is also a relevant assessment factor, which is to be proven through good financial reputation, financial capacities which are capable of supporting the business development and commitment to implementing certain measures if required.

Administrative requirements are imposed and self-assessments are required for candidates. For candidates for membership of boards of directors and candidates for membership of boards of commissioners, the requirements are more straight forward and could be fulfilled by the provision of relevant documents of candidates, such as identification documents, relevant affidavits and relevant licenses. On the other hand, for candidates for controlling shareholders, a wider range of documents would be required to satisfy the requirements. These documents include list of names and candidate data for individuals, financial capacity analysis documents prepared based on audited financial reports, capital deposit receipt from each shareholder, statement letter, police report statement and other supporting documents. Candidates for controlling shareholders would also be required to give presentations of their development plans for the next five years, together with candidate strategies to be employed in the event of liquidity difficulties or potential insolvencies.

Upon satisfactory of the above requirements, the investment manager or investment advisor of the candidate shall submit an application to the OJK with the relevant documents. The OJK will then process the application and notify the relevant investment manager or investment advisor of the results within 30 business days of the receipt of the application. Following approval by the OJK, the approved candidates for boards of directors and candidates for membership of boards of commissioners will have to be appointed through a general meeting of shareholders within 6 months of the approval date.

Other OJK regulations

It is worth noting that OJK has also issued 5 other regulations in the early months of 2020, as follows:

- POJK No. 14/POJK.05/2020 on Countercyclical Policies Against the Impact of the Covid-19 for Non-banking Financial Services Institutions, dealing with debt restructurings for borrowers affected by Covid-19;

- POJK No. 15/POJK.04/2020 on Shareholders’ Meetings for Public Companies, which covers remote participation and use of powers of attorneys during shareholders’ meetings for public companies;

- POJK No. 16/POJK.04/2020 on Electronic Shareholders Meeting for Public Companies, further regulating shareholders’ meetings for public companies through remote means;

- POJK No. 17/POJK.04/2020 on Material Transactions and Changes in Business Activities, which expands on the definition of material transactions and changes in main business activities for public companies; and

- POJK No.18/POJK.04/2020 on Written Order to Handle Bank Problems, which allocates rights to OJK to direct banks to consolidate or be taken over with the objective of maintaining financial system stability.

New regulations on the procurement of renewables

The Minister of Energy and Mineral Resources (“MEMR”) has issued Regulation No. 4 of 2020 (the “MEMR Reg. 4/2020”) regarding the second amendment to MEMR Regulation No. 50 of 2017 on the Utilisation of Renewable Energy Resources in Electricity Production (“2017 Regulation”).

The Regulation, which came into effect on 26 February 2020, relates to solar PV, wind, hydro, biomass, biogas, municipal waste and tidal projects in Indonesia. With an objective to accelerate the development of renewable energy, some of the key features of the Regulation are as follows:

- introduction of a direct appointment scheme to be undertaken by PT PLN (Persero) (“PLN”) for the purchase of electricity from power plants which utilise renewable energy resources (“Renewable Power Plants”);

- declaration that the build, own, operate and transfer (“BOOT”) scheme under the 2017 Regulation is now invalid for Renewable Power Plants;

- new mechanisms by which PLN may purchase electricity from specified Renewable Power Plants by way of special assignment from the MEMR to PLN.

Purchase through Direct Selection and Direct Appointment

The MEMR Reg. 4/2020 confirms the direct selection (pemilihan lansung) and direct appointment (penunjukan langsung) route for the purchase of electricity from Renewable Power Plants. Direct appointments are permitted in four specific situations:

- local electricity system is in a condition of electricity supply emergencies or crisis;

- the purchase of excess power, including the purchase of electricity through cooperation between holders of electricity supply business areas;

- the increase of generation capacity in power plant centers which already operate in the same location; or

- the purchase of electricity from Renewable Power Plants, if there is only one prospective electricity provider.

The relatively short timelines for these mechanisms are fixed: direct appointments must be completed within 90 days, from the initial qualification process, bid submission and evaluation, to the signing of the power purchase agreement. In contrast, direct selections must be completed within 180 days. Any power purchase agreement negotiated through either mechanism is required to adhere to the Electricity Supply Business Plan (Rencana Usaha Penyediaan Tenega Listrik) and last for a maximum contractual term of 30 years.

BOOT Scheme Disapplied

The BOOT scheme under the 2017 Regulation for electricity sale and purchase has been invalidated for Renewable Power Plants.

This is a positive development for Independent Power Producer (“IPP”) developers, opening up the possibility for a return to scheme which does not require handing the project back over to the government at the date of expiry or earlier termination of the PPA.

Special Assignment of Renewable IPPs

The Regulation contains new mechanisms relating to the purchase of electricity based on special assignment to PLN by the MEMR. In general these provisions relate to the following types of Renewable Power Plants:

- multi-functional hydro-electric power plants utilising reservoirs, dams and/or irrigation channels and built by a business entity partner selected as the winner for the use of state-owned water resources for hydropower purposes;

- municipal waste-to-energy power plants (PLTSa) using, among other, methane gas collection and utilisation for sanitary landfills and anaerobic-digestion technology, or other similar technology, from the results of landfills or through the utilization of thermal energy by using thermochemical technology; and

- renewable power projects built either partially or wholly by the government, except those built under MEMR Regulation No. 39 of 2017 (as amended by MEMR Regulation No. 12 of 2018), including those financed using state grants.

All of the assignments discussed in this section involving PLN purchasing the electric power under special assignment from MEMR will be deemed to be direct appointments.

Expectations for the Future

A more comprehensive renewable energy law is expected later this year including a highly anticipated regulation tackling the existing tariff policy, which has been calculated with reference to PLN’s cost of procuring power from the various systems/sub-systems set out in Decree No. 55K/20/MEM/2019 on the Amount of Cost of Generation Provision (often referred to as a “BPP” decree). These regulatory measures are intended to remove existing bottlenecks which have curbed Indonesia’s ability to meet its green energy commitments, including its target to achieve 23% renewable energy utilisation by 2025.